CRS Draft Law Overview

On November 4, 2014, Russia has ratified the OECD Multilateral Convention on Mutual Administrative Assistance in Tax Matters. The Convention, which entered into force in the territory of the Russian Federation on July 1, 2015, provides a legal basis for all kinds of tax information exchange among its members:

- On request;

- Proactive;

- Automatic.

The Convention includes Article 6, allowing the parties to exchange information automatically, which allegedly is important for the administration or enforcement of laws relating to the taxes, to which the Convention applies. At the same time, in accordance with the Convention such automatic exchange requires a separate agreement between the competent authorities of the parties. Multilateral agreement of the competent authorities on the automatic exchange of financial information (hereinafter, the Multilateral Agreement) constitutes such agreement.

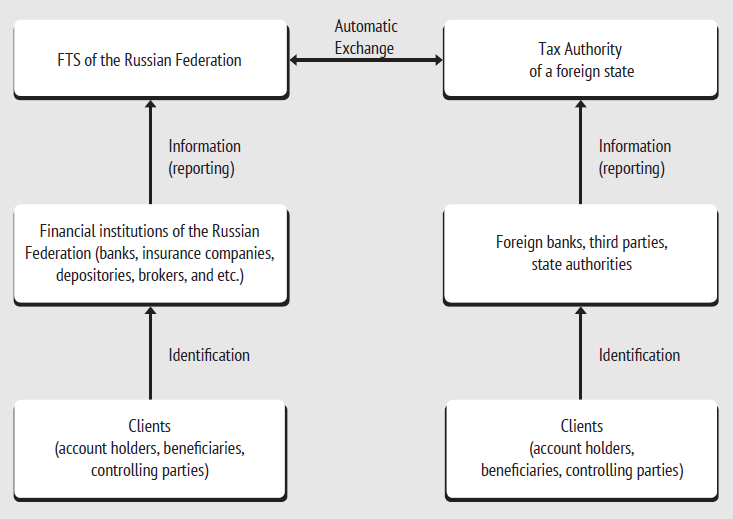

The implementation in practice of the Multilateral Agreement means that the automatic exchange of tax information will be based on the Common Reporting Standard developed by the OECD, which establishes the content and technical details of the information exchange process.

In implementing the obligations under the Convention, accession to the Multilateral Agreement shall begin from December 31, 2018.

In connection with the accession to the Multilateral Agreement, in the current year the Russian Ministry of Finance in conjunction with relevant agencies will develop and introduce the necessary changes to the legislation.

The Multilateral Agreement is a framework agreement, which validity begins after the entry into force of the relevant local legislation with regard to the requirements for the protection of personal data and confidentiality of information.

The local legislation of the Russian Federation shall set the following requirements with regard to:

- Identification procedures;

- Reporting to the Russian Federal Tax Service;

- Responsibility for violation of requirements of the Standard;

- Availability at the financial institutions of forms of documents aimed at compliance with the requirements of the Standard.

The draft federal law “On Amendments to Part One of the Tax Code of the Russian Federation (in connection with the implementation of the international automatic exchange of information on financial accounts documentation for international groups of companies)”, published on September 6, 2016, has been developed to ensure compliance of the Russian Federation with the conditions of the Multilateral Agreement.

If adopted, the draft law will come into force in the part relating to the exchange of information from January 1, 2017, which allows the Russian Federation fulfilling the requirements of the Standard from the year 2018.

The draft law establishes the obligation of the financial market organization in connection with the automatic information exchange to submit to the Federal Tax Service:

- Information on clients, beneficiaries and (or) persons directly or indirectly controlling them – tax residents of foreign states;

- Financial information on these persons;

- Other information related to the agreement executed between the client and the organization of the financial market for the provision of financial services.

The draft law establishes the following list of organizations related to financial market organizations:

- Credit institution;

- The insurer, operating on voluntary life insurance;

- Professional participant of the securities market, performing brokerage and (or) securities management and (or) depository activities;

- Administrator under the trust agreement;

- Private pension fund;

- Equity investment fund;

- Investment fund, mutual fund and private pension fund management company;

- Clearing organization;

- Managing partner of the investment company;

- Other organization or entity without legal personality, which within the framework of its activities receives money or other property from clients for storage, management, investment and (or) execution of other transactions to the benefit of the client, either directly or indirectly at the cost of the client.

Financial information includes the following information:

- On transactions, accounts and deposits of clients;

- On the amount of the insurer’s obligations under the contract of voluntary life insurance to clients of financial organizations or beneficiaries;

- On the amount and value of property held by the financial market organization in accordance with the agreement on brokerage services or trust management in the organization of the financial market;

- On the value of property accounted by the organization of the financial market, carrying out depository activities;

- On pension accounts;

- On the obligations of clearing organizations;

- On payments and transactions in connection with accounts and deposits, contracts of voluntary life insurance, trust management (including those certified by the issuance of an investment unit), agreements on brokerage and custody services, pension agreements, agreements with clearing organizations and other agreements, under which the financial market organization receives money or other property from clients for storage, management, investment and (or) execution of other transactions in the interest of the client, either directly or indirectly at the cost of the client.

The procedure and terms for the provision of information by the financial market organization and its structure will be established by the Government of the Russian Federation in coordination with the Bank of Russia.

Measures for the establishment of tax residency of clients, beneficiaries and persons, directly or indirectly controlling them will be defined in accordance with the normative legal act of the Government of the Russian Federation.

The draft law establishes liability of financial market organizations:

- In the amount of 500 000 rubles for violating the order, volume and (or) the timing for the provision of information;

- In the amount of 300 000 rubles for violating the procedures for the establishment of tax residency of clients, beneficiaries and persons, directly or indirectly controlling them.

At the same time, in case of failure to provide the requested information by the client of the financial market organization, the draft law establishes the right for this organization:

- To refuse to sign the agreement on the provision of financial services with such person;

- To terminate unilaterally the agreement on the provision of financial services.

Thus, the draft law defines the list of financial institutions subject to its requirements, the list of persons subject to the information exchange, the concept of financial information subject to the submission to the FTS by financial market organizations. The draft law also establishes the rights and obligations of financial institutions and their clients, defines the role and functions of the FTS in the process of information exchange and establishes liability for failure to comply with the requirements established by the draft law.

Currently, the draft law is in the process of public debate and anti-corruption expertise.

Most likely, the text of the draft law will be repeatedly updated and adjusted in the course of approval, and at the moment it is at the initial stage of approval, however, with high confidence we can say that in one form or another the draft law will be adopted and the described provisions, perhaps with some adjustments, will come into force in 2017.

In addition to the considered draft law, a large package of regulations detailing the specifics of information collection for sharing is to be developed, and a technical solution for the exchange of information is to be implemented. Special attention shall be paid to the safety of personal data.

Banks and financial institutions will be required to ensure the functioning of all procedures required in accordance with the CRS, namely, to implement the procedure of identification of new and existing clients and to establish a reporting system on the financial operations of foreign clients to the Russian tax authorities.