The Yellow Hound Brought Something Round!

The New Year brought numerous changes, particularly in taxation. Changes were introduced to various chapters of the Tax Code of the Russian Federation, i.e. Corporate Profit Tax, Personal Income Tax, Simplified Tax System, Insurance Premium, Property Tax and many others.

This article will cover those amendments that apply to the majority of legal entities and individuals in the Russian Federation.

Reintroduction of the personal property tax

According to Article 381.1 which was added to Chapter 30 of the Tax Code of the Russian Federation, the corporate property tax privilege applying to immovable property acquired after January 1, 2013 shall remain valid in 2018 provided such resolution is made on the regional level.

Clause 3.3 was added to Chapter 380 of the Tax Code of the Russian Federation, which states that tax rates determined by constituent entities of the Russian Federation regarding non tax-free immovable property shall not exceed 1.1% in 2018.

Regions shall determine for 2018 the availability of tax privileges as well as the tax rate in case of their absence.

The tax rate of 0% has been determined for Moscow and Moscow Region for the period from 2018 to 2020 regarding immovable property recorded as fixed assets since January 1, 2013, with known exceptions.

Given the estimation of the top rate in the Tax Code of the Russian Federation solely for 2018, it is likely to be revised for 2019 and further years.

Children first!

Since 2018, the legislation has introduced new birth (adoption) allowances for the first and the second child for families with an average income not exceeding 1.5- multiple of the minimum living wage set out for the constituent entity of the Russian Federation. Families are subject to monthly allowances upon the birth (adoption) of a child after January 1, 2018.

Monthly allowances for the birth (adoption) of the first or the second child are estimated at the level of the living wage for children set out for the constituent entity of the Russian Federation under Federal Law 134-ФЗ On the Lining Wage of the Russian Federation dated October 24, 1997 for the second quarter of the year preceding the year of application for the said allowances.

The living wage for children in Russia equals about 10 thousand roubles.

Moreover, in February 2018, birth allowances shall be adjusted according to 1.032 index.

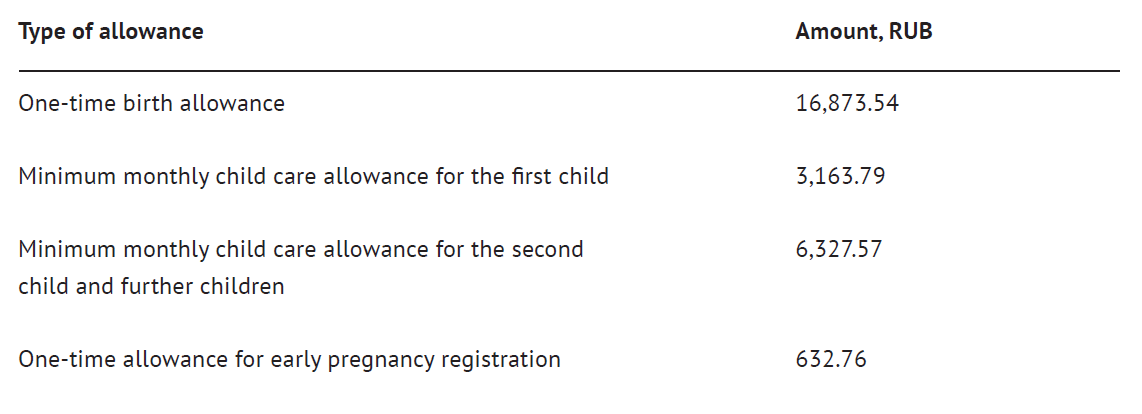

In 2018, the allowances shall be as follows:

Since 2018, the readjustment of child-related allowances shall take place on annual basis as of February 1.

Tax exemption for individuals and sole proprietors

On December 28, 2017, President of the Russian Federation signed the draft law which provides for tax authorities to charge off individuals’ arrears in transportation tax, personal property tax, land tax, arising as of January 1, 2015, and fine debts imposed for the said arrears.

Moreover, debts of sole proprietors in pro se insurance premiums accrued before January 1, 2017 shall be charged off.

The tax authority shall make a resolution on the debt charge-off based on the debt data of individuals and sole proprietors.

The Federal Tax Service has always been the administrator for personal tax debts, but it’s been only last year that non-budgetary funds transferred data on insurance premiums to the Federal Tax Service. Meanwhile, the data transfer on incurred and paid insurance premiums (particularly on legal entities) was performed incorrectly. Numerous long paid debts were disclosed, and data on payments and on 2016 returns were lost in the process.

Given last year precedents of incorrect data registration on insurance payments, sole proprietors with debts shall check with their tax authorities in advance in order to fully charge off their debt.

No interest? Here you go!

Since June 1, 2018, unless a loan agreement directly states that a loan is interest-free, interest is charged at the current key rate of the Bank of Russia as of the interest period.

The said provisions were added to Article 809 of the Civil Code of the Russian Federation. Now the absence of interest mentioning in the agreement does not qualify it as a reason for not charging it.

A special warning has also been introduced regarding interest overestimation for legal entity lenders that do not provide consumer loans on a professional basis. The amount of loan interest under a loan agreement between individuals or a legal entity and an individual, which twice or more times exceeds the standard interest charged in similar cases, and therefore, is too burdensome for a debtor, may be cut by the court order down to the interest amount chargeable in comparable circumstances.

Additional insurance premium deferrals for sole proprietors

Additional insurance premiums on compulsory pension insurance shall be paid by sole proprietors in case their annual income exceeds 300,000 roubles at the rate 1% of the excess amount.

Earlier, the due date for additional premium payments was set until April 1 of the year following the reporting period. From additional premium payments for 2017 the due date is set until July 1, 2018.

The said changes do not provide more time to calculate the amount, as the due date for tax filing under the simplified tax system (the most common tax system among sole proprietors) is still April 30. The said provision shall solely provide deferrals for insurance premium payments based on the actual income received.

Be careful when filing in ‘Calculation of insurance premium’

The Federal Tax Service continues to stiffen the filling procedure for the calculation of insurance premium and sanctions for its violation. Once again, payers of insurance premium will have to file a new form for 2017.

The due filing date of the calculation of insurance premium shall remain unchanged, i.e. until January 30, 2018.

Tax authorities shall not accept the calculation of insurance premium, if they reveal discrepancies between section 1 (consolidated data on accruals) and section 3 (personalized data).

Last year tax authorities accepted calculations of insurance premium with the said discrepancies and demanded to file a revised calculation. In 2018, such discrepancies will serve as a reason for refusal and penalty charging, unless a payer of insurance premium files the correct calculation in due time.

In addition to that, the maximum amount of personal income chargeable at the standard rate in 2018 shall amount to:

- 815,000 roubles for insurance premium on social security;

- 1,021,000 roubles for insurance premium on compulsory pension insurance.

Maximum limits for insurance premium on compulsory medical insurance have not been determined yet.

Personal financial benefit: income or not?

The Tax Code was amended regarding tax burdens on personal income in the form of financial benefits from interest savings.

Since January 1, 2018, taxes on financial benefits from interest savings shall be charged only in cases:

- the income is received from an affiliated company (sole proprietor) or an employer;

- the income is in the form of a financial aid or reciprocal performance of obligations to an individual.

Moreover, since January 1, 2018, if the company remits the individual of the debt, he/she acquires the income (financial benefit) in the form of the remitted debt, provided the company is affiliated with the individual.

If there is no evidence of affiliation, there is no income chargeable with the personal income tax.

VAT: separate without limits

Up until the new year, the obligation of separate accounting was imposed on those taxpayers which operating VAT-free expenses exceed 5% of the total expenses.

Since 2018, separate accounting is obligatory for all taxpayers performing either VAT activities or VAT-free activities. The rule of 5% shall be eliminated.

However, the right to accept VAT deductions on tax-free activities within 5% shall remain.

Thus, the said amendments complicate accounting, but do not aggravate tax burdens.

Happy New Year and happy new report!

Until March 1, 2018 all employers have to file a new SZV-STAZH (СЗВ-СТАЖ) report to the Pension Fund of the Russian Federation on the pensionable service of its employees.

Insurers fill in and file SZV-STAZH on all insured persons that are engaged in labour relations with the insurer or have entered into civil law contracts with it regarding work performance.

The report shall contain the data on all its employees, period of employment in the reporting period, grounds for preferential service and other data.

Moreover, since January 1, 2018, new tax return forms on transportation and land taxes are introduced. The tax return on the land tax has undergone no significant changes.

The new tax return on the transportation tax shall contain the following additional data:

- Registration date of the vehicle;

- Deregistration date of the vehicle;

- Vehicle manufacture year;

- Tax deduction code;

- Tax deduction amount (RUB).

The due filing date of tax returns on transportation and land taxes has remained unchanged, i.e. until February 1, 2018.