CRS: Beginning of the Transparency Era

Russian business is a young substance, which had to come through a lot even over this short period. The time has proved that a Russian entrepreneur, who survived in the early 90s, and came through 1998 and 2008, is prepared for anything and knows like no other that the only constant thing is changes. Today a Russian entrepreneur is offered a new cocktail. It consists of a mix of exotic ingredients: AML, CFC, BEPS, real substance, transfer pricing, controlled indebtedness, CFC, AVD, conduit, and CRS.

CRS – common reporting standard – is a document issued by the OECD in the course of implementation of the BEPS plan and establishing general rules of international automatic data exchange – the last ingredient of this cocktail, which made the Russian business believe that the new era has finally come.

Fishing Expeditions

Information exchange as such is no news. It existed earlier, but had been carried out on request.

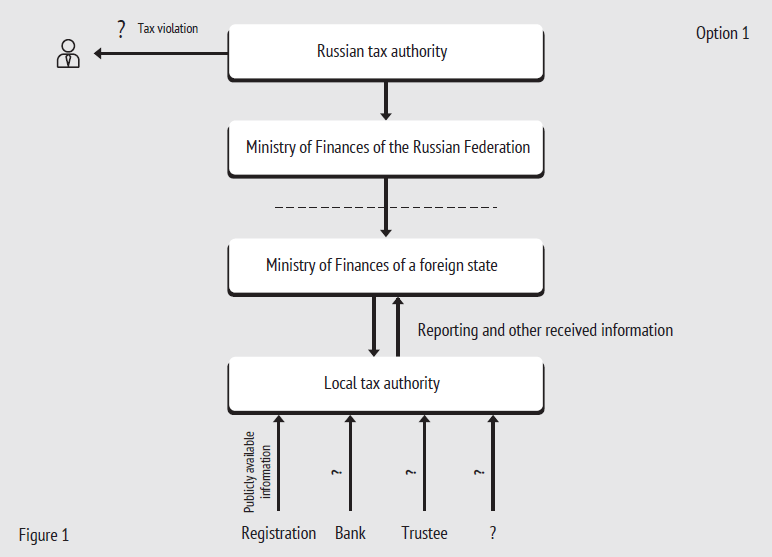

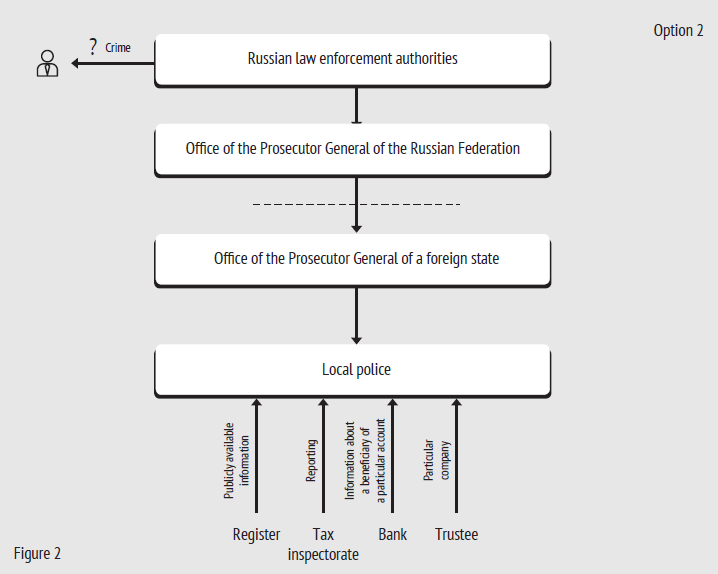

How does disclosure of information on request or, in other words, fishing expeditions work? A competent authority of one state, carrying out investigation of a violation or a crime, makes a request concerning a particular taxpayer to a competent authority of the other state. Subject to a bilateral or a multilateral agreement on information exchange, the other state makes requests to national authorities, which can provide the necessary information: local registers, tax authorities, police, banks, or corporate service providers. In response to such requests, authorities provide available information, which is not kept as commercial or professional secret. The said information is further submitted to the requesting authority. Thus, to obtain information on request, the following conditions should be met simultaneously:

- Existence of an investigation concerning a particular person in the country of request;

- Existence of agreement on information exchange between the country of request and the country of response (for example, agreement of mutual assistance in civil cases, or agreement on tax information exchange);

- Availability of information with national authorities;

- Willingness and possibility of such authorities to disclose information.

That is, to disclose information, apart from observing all formalities, the interested authority needs luck just like in any fishing. The following charts outline information exchange within fishing expeditions:

Automatic Exchange

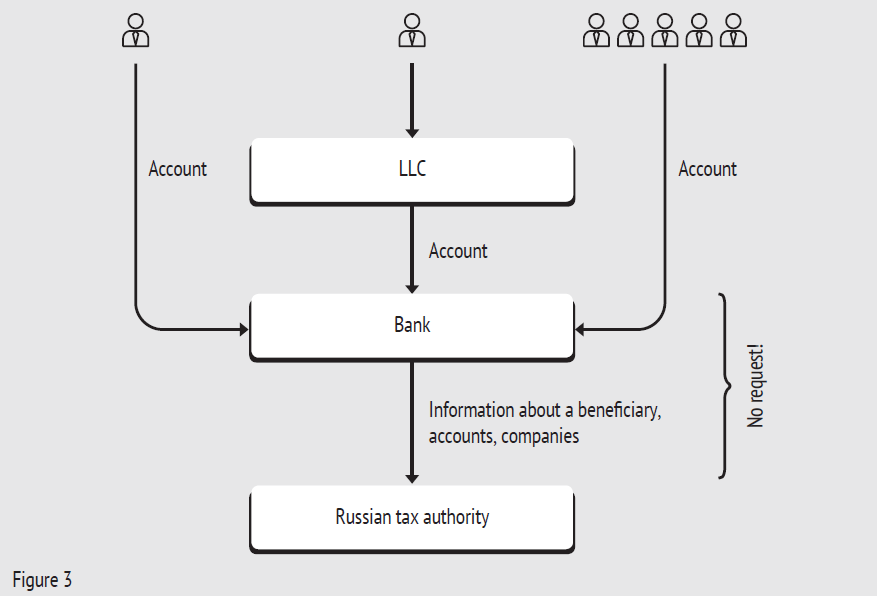

Yet, automatic information exchange does not make the receipt thereof contingent upon luck. Moreover, it does not make the receipt of information contingent upon the fact that the person has committed a violation or a crime. The automatic information exchange means that all authorities, obliged to disclose information, will automatically provide such information immediately upon the receipt thereof. The following chart outlines the automatic information exchange:

As recently as few years ago, Russian business had to deal with hardening of liability for violation of foreign exchange legislation by individuals, last year – with legislation on controlled foreign companies and actual income recipients, this year – with the necessity to provide reports on foreign accounts. As a result of such changes, Russian tax residents faced a number of new responsibilities related to disclosure of information about their activities abroad. Everyone wondered whether our tax authorities possessed resources to search and collect information about participation of Russian tax residents in foreign entities. The only source to adopt similar experience from was the Internal Revenue Service. In 2014, the Foreign Accounts Tax Compliance Act also known as FATCA came to effect. It was adopted in 2010 by the US authorities for the purposes of combating tax evasion by US entities owning foreign financial assets and offshore bank accounts. This Act has caused extreme concern of financial institutions around the world, as one of the measures to combat tax evasion by US entities stipulated the obligation of non-US financial entities to report to the Internal Revenue Service about financial accounts directly or indirectly owned by US entities. Failure to submit the specified information to the US tax authorities or failure to observe the rules stipulated by FATCA may lead to the retention of fine in the amount of 30% from certain payments from the US sources received by a financial entity that has not joined FATCA or violates its provisions.

However, most experts agreed that for this step Russia lacked both leverage on the global stage and the experience in implementing similar projects. Political differences existing on the global stage at the time suggested that Russia’s access to the channels of international information exchange was questionable. Accordingly, depending on the degree of optimism, the taxpayer decided on whether to disclose or not to disclose the information. Most of the business regarded these innovations with caution and adopted wait-and-see attitude. While representatives of the Russian financial authorities repeatedly stated Russia’s intention of full inclusion into the process of automatic information exchange as a rightful participant from 2018. Promises materialized on May 12, 2016.

Who? What? When?

The Russian Federation ratified OECD Convention on Multilateral Administrative Assistance in Tax Matters on November 04, 2014, and it became effective from July 01, 2015. Under Article 6 of the Convention, the parties can automatically exchange information between each other pursuant to procedures determined by mutual agreement. Thus, Competent Authority Agreements determine deadlines, scope and procedures for information exchange among the signatory jurisdictions.

There are three types of model agreements:

- “Mutual” bilateral: is applied in conjunction with Article 26 of model agreement on double taxation avoidance;

- Multilateral: requires no execution of separate bilateral agreements and is applied by parties to the Convention, which have joined the agreement. Signed by the Russian Federation on May 12, 2016;

- “Non-mutual” bilateral: particularly with jurisdictions where there is no income tax.

Moreover, for any of the abovementioned mechanisms to work, the base of local (national) legislation which must stipulate the following aspects is required:

- Identification procedure;

- Submission of reports to the Russian Federal Tax Service;

- Liability for violation of the standard;

- Existence within financial institutions of internal documents aimed at compliance with requirements of the standard;

- Procedures for protection of personal data and other information transmitted in the course of cross-border exchange.

Information exchange is scheduled to begin from 2017. About 60 countries have declared their intention to start automatic information exchange from then on. Other countries plan to ensure the information exchange from 2018. This group includes without limitation Russia, Austria, Switzerland, Monaco, UAE, Saudi Arabia, Singapore, Israel, Andorra.

USA, which in fact initiated the process of creation of global network of financial information exchange by pinning down the world community to the fact of FATCA entry into force. Since Russia is not a US partner in FATCA, in practice it means that Russia cannot receive information from US financial institutions, whilst Russian financial structures actively provide US authorities information about the US entities.

Today, in addition to the USA, such countries as Bahrain, Kuwait, the Maldives, Panama, Thailand, Moldova, and the majority of countries located in the post-Soviet region, such as Armenia, Azerbaijan, Belarus, Bulgaria, Georgia, Kazakhstan, Ukraine, Kyrgyzstan, Uzbekistan, Turkmenistan and Tajikistan have refused to support and joint the Standard. However, they can change their mind in the future. It should also be borne in mind that the information exchange with these countries is possible through other channels of tax information exchange (for example, by virtue of Double Taxation Avoidance Agreements).

At the same time, the so-called early adopters (for example, the UK, BVI, Cyprus) will start exchanging information for 2016 in 2017. Jurisdictions included into the “Non-early adopters” group (Russia and Switzerland, in particular) will start exchanging information for 2017 in 2018.

To ensure that information for a certain year is received by Russian tax authorities from other jurisdiction, both countries should develop the necessary legislation and processes and submit notification on their willingness to exchange information related to this year.

If legislation of other jurisdiction requires submission of reports for 2016, while the Russian legislation does not, the Russian Federal Tax Service shall start receiving information from foreign jurisdictions for 2017 presumably from 2018.

The obligation to provide information will first affect banks, and then it will be extended to other financial entities, brokers, and trustees. The beginning of automatic information exchange will mean for the Russian taxpayer that in the event of opening an account for himself/herself as an individual or for a company, whose beneficiary he/she is, the bank located in the country, which has signed the international agreement, will automatically send information thereon to the Russian tax authorities. The specified information will be further used by tax authorities for general tax administration. All violations related to illegal currency transactions or failure to include the CIC’s income into the tax base, will be soon available for investigation by Russian tax authorities. What seemed impossible a few years ago has become a reality. In this situation, Russian taxpayers can no longer exercise their wait-and-see attitude, they need to change their approach to management of assets, foreign companies and private finances. Until 2018, taxpayers still have time to enter the new era by diversifying their old risks.