Payment Settlements With Electronic Money

Trade development, including via the Internet, led to the search of new faster and more efficient means of payment. Such means were discovered and implemented with the introduction of electronic non-cash payment and electronic money. Electronic money has a number of significant advantages in comparison with traditional payment instruments. Payment settlements with electronic money do not require conducting of each transaction via bank, which facilitates execution of deals. Electronic money is counterfeit-proof and difficult to steal. Even in case of stealing technical support will identify the fact of theft and money will be returned. Moreover, digital wallet maintenance is duty free, unlike some bank cards. One more significant advantage is anonymity, because customers are not obliged to submit their documents in order to open an account.

Nowadays it may be complicated to understand the nature of electronic money and whether it may be regarded as money at all. It’s difficult to call it “money” in a traditional sense. Unlike usual cash payments, in case of payment settlements with electronic payment instruments, the participation of an intermediary, i.e. a credit institution, is required. Nowadays there are many terms related to electronic payments, including electronic money, electronic payment instruments, non-cash payment via the Internet. This article will cover the abovementioned terms.

First of all, a line must be drawn between two terms: electronic money and electronic payment instruments. Federal Law No. 161-FZ dd. 27.06.2011 On the National Payment System contains definitions of these terms. According to Clause 18 Article 3 of the Law, electronic money is money previously rendered by one person to another considering the information on the amount of the rendered money without opening a bank account, for the purposes of fulfilment of monetary obligations of the rendering person with third parties and in regard to which the rendering person has a right to transfer instructions exclusively with electronic payment instruments. According to Clause 19 Article 3 of the Federal Law On the National Payment System, electronic payment instrument is an instrument and/or means that allows a client of a money transfer operator to execute, certify and deliver instructions with the purpose of money transfer within the used forms of non-cash payment using information and communication technologies, electronic data storage devices, including payment cards, and other technical devices which allow to create information of payments and exchange it electronically.

Thus, in essence electronic money is prepaid receivable that is recognized for the fulfilment of monetary obligations of the rendering person with third parties. Electronic payment instrument is an instrument that allows a client to manage funds using electronic technologies.

Electronic and non-cash money is similar, as both electronic and non-cash money may be recognized and transferred via electronic channels. In accordance with civil law provisions, both electronic and non-cash money is considered as receivables. This receivable is respectively due either to a bank or to an issuer. However, non-cash money is recorded as entries on each client’s bank accounts and serves as an equivalent of deposited money. But in order to open an electronic account, a client “purchases” electronic money that is recognized on an accumulative account, and later uses that money to repay electronic money by means of its exchange for usual money on receiver’s request. This electronic account is called digital wallet or virtual account, where client’s rights are recognized.

Electronic money is basically a prepaid financial product, and a client may request its repayment at an electronic money transfer operator, i.e. its exchange for cash or non-cash money. Whereupon, legislation allows to issue only prepaid electronic money in order to preserve state emission monopoly.

Electronic money may be stored, i.e. recognized, by different means. It may be stored on chip cards, when a data storage device is a special micro chip, or it can be stored via special software installed on a holder’s personal computer or issuer’s server. Therefore, electronic money may be managed either by actual giving of a chip card or by transfer of this object via the Internet. This is the main difference of electronic money from such instruments of remote access to accounts as bank cards or online banking systems. These instruments are means of managing non-cash money on a usual bank account. Thus, a magnetic stripe bank card unlike a chip card means that a client has a bank account, while digital money is an independent object.

Despite the fact that nowadays a lot of specialists recognize electronic money as an independent object, it cannot be considered a “full-value” payment instrument, because one requires usual cash or non-cash money for its emission or repayment. Nowadays legislators aim at recognition of electronic money as a valid payment instrument. For example, Article 46 of the Tax Code allows collecting taxes and other statutory charges in the form of electronic money.

Payment settlement

According to Article 7 of the Law On the National Payment System during non-cash payment settlement in the form of electronic money transfer, a client renders money to an operator of electronic money in accordance with a signed agreement.

According to this Article, a natural person may render money to an operator of electronic money using his/her bank account or otherwise. A legal person or individual entrepreneur renders money only using his/her bank account. The operator recognizes the money rendered by making an entry of the amount of operator’s obligations to the client in the amount of money rendered by the client. According to the legislation of the Russian Federation, the functions of such operators may be performed only by credit institutions, including non-bank credit institutions with a right to transfer money without opening bank accounts. All legal relations with electronic money payments must be assisted by an electronic money operator, which turns such legal relations into three-party relations.

Thus, for payment settlement various contractual arrangements must be performed.

Introduction of electronic money as a legal object

At this stage a client credits money to a payment system. As a result, the client acquires receivables to the issuer of electronic money.

In legal terms such relations may be qualified as a mixed loan and sales and purchase agreement.

Getting access to the system

These relations arise from the access to a technical device or by the usage of a computer program. As it was mentioned before, electronic money may be recognized on a server of a payment system or stored with the help of computer software. Legal arrangements for such relations are performed in the form of access providing agreement or license agreement.

Purchase of goods and services

It may be performed via the Internet or using a card that stores electronic money.

Therefore, these are basic sales and purchase agreements.

Money transfer to clients

When a client credits money to a payment system, he/she acquires receivables to the issuer. An agent (i.e. a payment system operator) transfers electronic money from a sender to a recipient on behalf of an issuer.

Therefore, relations between an issuer and an agent may be qualified as commission relations.

Exchange of electronic money for traditional money

Electronic money is exchanged for traditional money upon client’s request.

It may be qualified as fulfillment of a mixed loan and sales and purchase agreement.

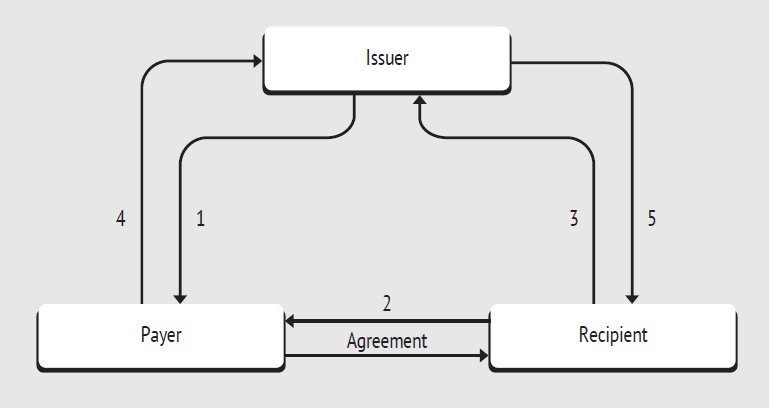

Electronic money payment follows the scheme below:

- Issuer renders prepaid electronic money to Payer.

- Payer and Recipient enter into sales and purchase agreement.

- Recipient requests payment from Issuer.

- Payer gives instructions to Issuer.

- Recipient gets money.

Therefore, electronic money is receivable to the issuer and is a specific legal object. Electronic money is not money in the usual sense of the word, but electronic money payments are legal and useful for goods and service payments via the Internet. Such payments require intermediaries: a payment system operator and an electronic money issuer.