Реформа корпоративного законодательства

Ушедший 2014 год запомнился чередой важных и существенных изменений, затронувших основы гражданского законодательства России.

Принятые нововведения не обошли стороной и ту часть гражданского законодательства, которая посвящена регулированию корпоративных правоотношений. Предлагаем рассмотреть более важные из них.

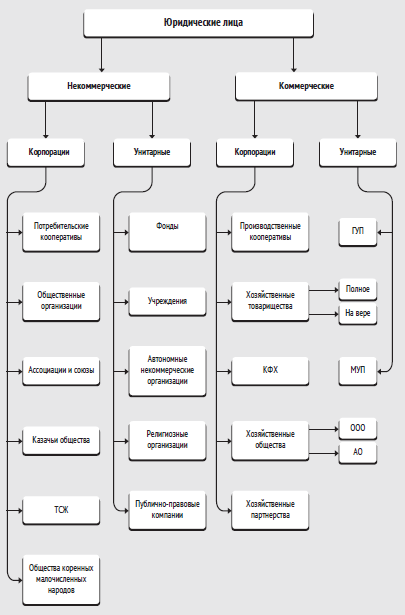

Организационно-правовые формы юридических лиц

Новая редакция Гражданского кодекса РФ закрепляет иной подход к классификации видов и организационно-правовых форм юридических лиц. Так, все юридические лица (как некоммерческие, так и коммерческие) теперь подразделяются на корпорации и унитарные образования.

К корпорациям относятся организации, участники в которых обладают правом участия в них и формируют высший орган управления. Организации, учредители которых не становятся участниками и не приобретают права членства, являются унитарными. В отношении корпораций законом установлены единые правила управления и права участников. Аналогичных норм в отношении унитарных организаций не установлено.

Сам перечень организационно-правовых форм организаций существенного изменения не претерпел. Тем не менее, некоторые изменения произошли. Так, из числа возможных форм хозяйствования исключены общество с дополнительной ответственностью (ОДО), а также закрытое акционерное общество (ЗАО). Помимо этого создана новая организационно-правовая форма некоммерческой организации – товарищество собственников недвижимости, под которой понимается объединение собственников недвижимых вещей, созданное для совместного владения, пользования и в установленных пределах распоряжения имуществом, находящегося в общей долевой собственности (общем пользовании), а также для достижения иных целей.

Схематично, новую классификацию юридических лиц можно изобразить на схеме:

Хозяйственные товарищества и общества

Хозяйственными товариществами и обществами являются коммерческие организации с разделенными на доли (вклады) учредителей (участников) уставным (складочным) капиталом.

В соответствии с нововведениями хозяйственные общества были разделены на публичные и непубличные. К публичным относятся акционерные общества, акции которых публично размещаются или публично обращаются в порядке, установленном законом о рынке ценных бумаг. Положения о публичных обществах применяются также к акционерным обществам, в уставе и фирменном наименовании которых содержится указание на то, что общество является публичным. К непубличным обществам относятся общества с ограниченной ответственностью и акционерные общества, не отвечающие требованиям публичности.

Немаловажным нововведением также является предоставление возможности определять объем правомочий непубличного хозяйственного общества не только пропорционально долям в уставном капитале, но и по иным правилам, если это предусмотрено уставом общества или корпоративным договором. При этом сведения о корпоративном договоре и о предусмотренном в нем объеме правомочий участников общества будут содержаться в ЕГРЮЛ.

Кроме того, теперь при внесении участниками общества неденежных вкладов в уставный капитал, стоимость таких вкладов должна определяться только оценщиком. Оценка неденежного вклада, определенная участниками, не может быть выше оценки, установленной независимыми оценщиками.

Также были изменены правила оплаты уставного капитала при создании хозяйственного общества – по общему правилу, учредители общества обязаны оплатить не менее ¾ его уставного капитала до государственной регистрации общества. Оставшаяся часть должна быть оплачена в течение первого года деятельности общества. Иные правила могут быть предусмотрены законом. При этом, если законом допускается регистрация общества без предварительной оплаты ¾ уставного капитала, то участники общества несут субсидиарную ответственность по его обязательствам, возникшим до полной оплаты уставного капитала.

Гражданский кодекс теперь также содержит положения, конкретизирующие порядок заключения корпоративного договора, определяющие его содержание и форму. Так, участники (все или некоторые) хозяйственного общества вправе заключить между собой договор об осуществлении корпоративных прав, в соответствии с которым они обязуются осуществлять эти права определенным образом или воздержаться от их осуществления. Корпоративный договор должен быть заключен в письменной форме путем составления одного документа, подписанного сторонами. О факте заключения такого договора участники обязаны уведомить общество (при этом раскрывать его содержание не обязательно). В случае, если корпоративный договор был подписан всеми участниками общества, то его нарушение может рассматриваться как основание признания недействительным решения органа хозяйственного общества по иску участника.

Также теперь для принятия общим собранием участников общества с ограниченной ответственностью решения обязательным является нотариальное удостоверение, если иной способ (в т.ч. подписание протокола всеми участниками или частью участников; с использованием технических средств, позволяющих достоверно установить факт принятия решения; иным способом, не противоречащим закону) не предусмотрен уставом общества либо решением общего собрания участников общества, принятым участниками общества единогласно.

Возложение ответственности на контролирующих лиц

Для лиц, уполномоченных выступать от имени юридического лица, а также для членов коллегиального управления, установлена обязанность действовать разумно и добросовестно. При нарушении данной обязанности указанные лица обязаны возместить обществу причиненные в связи с этим убытки по требованию самого общества или его участников. Всякое соглашение об ограничении такой ответственности ничтожно.

Кроме того, ответственность за причиненные юридическому лицу убытки несет и иное лицо, которое имеет фактическую возможность определять действия юридического лица, включая возможность давать указания членам органов управления.

Учредительные документы юридических лиц

Согласно общему правилу, единственным учредительным документом любой организации является ее устав. Однако, хозяйственные общества также могут действовать на основании учредительного договора, который также имеет силу устава. При регистрации юридических лиц также могут использоваться типовые уставы, формы которых утверждаются уполномоченным госорганом.

Процедура создания юридического лица

В соответствии с нововведениями были установлены универсальные правила в отношении принятия решения о создании юридического лица. Так, при создании юридического лица двумя и более учредителями, решение о создании должно быть принято ими единогласно. В решении при этом должны быть указаны сведения об учреждении юридического лица, об утверждении его устава, о порядке (размере, сроках, способах) образования его имущества, об избрании (назначении) его органов.

В случае если принимается решение о создании организации корпоративного типа (основано на членстве), то в этом решении необходимо указать сведения о результатах голосования учредителей по вопросам учреждения и о порядке совместной деятельности учредителей по созданию юридического лица.

Процедура реорганизации юридического лица

Новые нормы предусматривают возможность проведения смешанной реорганизации, а также одновременной реорганизации нескольких юридических лиц.

Смешанная реорганизация означает возможность одновременного сочетания различных форм реорганизации (слияние, присоединение, разделение, выделение, преобразование). Ранее возможность смешанной реорганизации была косвенно предусмотрена только для акционерных обществ, теперь такого исключения в законе не содержится, и данное правило распространяется на все юридические лица. Помимо этого, появилась возможность осуществить реорганизацию с участием двух и более юридических лиц, в том числе созданных в разных организационно-правовых формах.

Кроме того, в результате принятия нововведений, было существенным образом изменено регулирование прав кредиторов реорганизуемой компании в сторону существенного улучшения их защиты. Важным новшеством стало введение солидарной ответственности вновь образованного юридического лица по долгам реорганизованного лица в случае если правопреемника по обязательству определить невозможно или в случае недобросовестного распределения активов и обязательств.

Также следует отметить, что новым законом предусмотрена возможность признать недействительным решение о реорганизации юридического лица, а также признать реорганизацию несостоявшейся. Правом на предъявление требования о признании недействительным решения о реорганизации обладают участники реорганизуемого лица, которые могут обратиться в суд в течение 3-х месяцев с момента внесения в ЕГРЮЛ записи о начале процедуры реорганизации.

Признание решения о реорганизации недействительным не влечет ликвидации вновь образованных юридических лиц, а также не является основанием для оспаривания сделок, совершенных данными юридическими лицами. Единственным последствием признания решения о реорганизации недействительным является предоставление участнику реорганизованного лица, голосовавшему против такого решения, требовать возмещения убытков от следующих лиц:

- от лиц, которые недобросовестно способствовали принятию решения о реорганизации;

- от юридических лиц, образованных в результате реорганизации, решение о которой признано недействительным.

Однако, если реорганизация будет признана несостоявшейся, то будут наступать совершенно иные последствия, а именно:

- будут восстанавливаться юридические лица, существовавшие до проведения реорганизации, а также одновременно будет прекращаться существование образованных в результате реорганизации лиц;

- сделки вновь образованных юридических лиц с контрагентами, которые добросовестно полагались на правопреемство, сохраняют силу для восстановленных юридических лиц, которые являются солидарными должниками и солидарными кредиторами по таким сделкам;

- переход прав и обязанностей признается несостоявшимся, за исключением случая, когда такие права и обязанности переходят в пользу нового юридического лица от должников, добросовестно полагавшихся на правопреемство на стороне кредитора;

- участники ранее существовавшего юридического лица признаются обладателями долей участия в нем в том размере, в котором доли принадлежали им до реорганизации, а при смене участников юридического лица в ходе такой реорганизации или по ее окончании доли участия участников ранее существовавшего юридического лица возвращаются им.

Необходимо отметить, что реорганизация может быть признана несостоявшейся только в судебном порядке и только по требованию участника, голосовавшего против или не принимавшего участия в собрании при принятии данного решения. Реорганизация может быть признана несостоявшейся в следующих случаях:

- если участники не принимали решение о реорганизации;

- если для государственной регистрации были представлены документы с заведомо недостоверными сведениями.

Процедура ликвидации юридического лица

Новая редакция Гражданского кодекса РФ конкретизирует основания ликвидации организаций в судебном и внесудебном порядке. Так, юридические лица могут быть ликвидированы на основании решения суда в следующих случаях:

- в случае признания государственной регистрации юридического лица недействительной, в том числе в связи с допущенными при его создании грубыми нарушениями закона, если эти нарушения носят неустранимый характер;

- в случае осуществления юридическим лицом деятельности без надлежащего разрешения (лицензии) либо при отсутствии обязательного членства в СРО или необходимого в силу закона свидетельства о допуске к определенному виду работ, выданного СРО;

- в случае осуществления юридическим лицом деятельности, запрещенной законом, либо с другими неоднократными или грубыми нарушениями закона или иных правовых актов;

- в случае систематического осуществления общественной организацией, благотворительным и иным фондом, религиозной организацией деятельности, противоречащей уставным целям таких организаций;

- в случае невозможности достижения целей, ради которых оно создано, в том числе в случае, если осуществление деятельности юридического лица становится невозможным или существенно затрудняется;

- в иных случаях, предусмотренных законом.

Во внесудебном порядке юридическое лицо может быть ликвидировано по решению его учредителей (участников) или органа, уполномоченного уставом.