Complicated Life of the “Simplified” and Other Changes in the Tax Legislation

The year 2016 was full of events in the field of geopolitics, which partly shaded the considerable effort that our legislator applied throughout the year in an effort to create a legal framework that meets today’s challenges and trends in Russia. Such efforts can be indeed considered significant, because this year the State Duma set a record: 6 165 bills were considered, of which 1 994 were adopted and signed by the President of Russia, 4 171 were rejected.

Some changes, which came into force during the year, have been unjustly deprived of attention against the background of more dramatic events taking place in the international arena. This article will present some changes in the Russian tax legislation to be aware of in 2017.

The new year has brought good news for companies that use the simplified taxation system

Legal entities and individual entrepreneurs, starting their professional commercial activity, may choose one of two options of the tax system: general or simplified.

Simplified tax system (STS) allows companies and individual entrepreneurs to significantly optimize their tax obligations to the state. In this regard, many business entities apply this system of taxation.

Since STS is focused on small and medium-sized businesses, the legislator has set certain limitations on the possibility of its application so that “simplified tax system” could not be used by major players in the market. In particular, these restrictions concern the number of people in the company, the value of income for the reporting period, the size of the permissible residual value of fixed assets.

So, from January 1, 2017, the following changes came into effect:

- The maximum amount of the company’s income for the transition to a simplified system of taxation equals 112.5 million rubles.

This means that from January 1, 2018 a taxpayer has the right to transmit to the simplified tax system, if his income does not exceed the above amount.

At the same time, the indexation of the maximum income size for the value of the deflator coefficient (as it was before) is suspended until 2020.

If the company combines several tax regimes (for example, general and UTII), when determining the maximum amount of income for the purposes of the transition to the STS it takes into account only the income received in the implementation of activities, which uses a general system of taxation. That is, if the company applies only UTII, it does not define the maximum size of income for the purposes of the transition to STS and does not indicate it in the appropriate notification.

At the end of 2016, the maximum size of income for retaining the right to use the simplified tax system should not exceed 79.740 million rubles (60 million rubles × 1.329 (deflator coefficient for 2016)).

- The limit of residual value of fixed assets for the transition to a simplified system of taxation and application of this tax regime is 150 million rubles.

Until 01.01.2017, the company could use the simplified tax system, if the net book value of its fixed assets did not exceed 100 million rubles. We draw attention to the fact that the limit of value of fixed assets shall be based on all activities.

The way income and expenses will be determined

Income at STS is taxed at the full amount (if “income” is selected as the object of taxation) or net of any expenses (object of taxation “income minus expenses”). The composition of income comprises income from sales and non-operating income, determined in accordance with the provisions of the tax legislation, i.e. the same as for the purposes of corporate income tax. It should be borne in mind that the calculation of tax revenues related to the activities transferred into UTII are not accounted (they are accounted for separately). Also, the composition of income under the simplified tax system does not include the following income:

- The amounts of taxes returnable from the state budget according to the provisions of the Tax Code of the Russian Federation, because such amounts are neither income from sale nor non-operating income;

- The amounts of collateral or deposit obtained in the proof of the conclusion of the contract and to secure its implementation at the time of receipt;

- The amounts of returned advances and prepayments, provided the amount of advances and prepayments paid by the sellers of goods were not included as an expense in the determination of the tax base (otherwise the returned amount of advances and prepayments should be accounted by the taxpayer in the taxation as income);

- Entry fees, membership fees, share contributions, donations (non-profit organizations under STS).

If the taxpayer has chosen “income minus expenses” as the object of taxation, it determines the tax base as the income received, reduced by the costs incurred. The costs should be economically justified and documented. The list of expenses that a taxpayer under STS may accept for a reduction of income received includes, in particular, advertising expenses of produced and (or) sold goods (works, services), a trademark and a service mark.

When calculating the tax under the simplified system of taxation, the following costs are not taken into account:

- To pay for services for the special assessment of working conditions;

- To pay for information services;

- To pay for the right to install and operate an advertising structure (for the taxpayer being the owner of advertising);

- For the purchase to employees of bottled drinking water;

- For subscriptions to newspapers, magazines and other periodicals;

- For the services of an accredited specialized organization for labor protection;

- For the purchase of the option for the right to sign a lease agreement.

Details for the taxpayers who have to report via the Internet

Innovations will be applied in respect of taxpayers and tax agents who are required to file declarations via telecommunication channels. At the moment, these are:

- Major taxpayers;

- Companies and entrepreneurs, which average number of employees in the preceding year exceeded 100 persons;

- Newly created companies with an average number of employees exceeding 100 people;

- Companies and individual entrepreneurs, who file the VAT return.

The changes relate to the periods within which it should be possible to receive electronic documents from the inspection that is to connect to a system for submitting reports. Beginning July 1, 2016, 10 days will be given to implement this obligation. 10 days are counted from the day when the obligation to file declarations in electronic form arose to the person. For failure to fulfill the obligation to file the reporting, the tax authority may decide to block the settlement account of the taxpayer.

It is worth noting that once a company or an individual entrepreneur provides the opportunity to receive electronic documents, the ability to conduct transactions on the accounts and make transfers of electronic funds will be restored. The next day, the IRS employees are required to remove the block.

Regarding the deadline for sending an e-receipt of acceptance, it will be still 6 days.

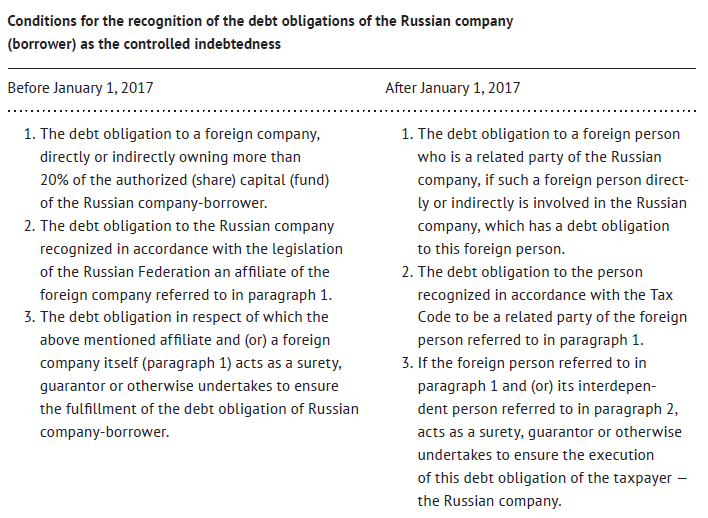

About the controlled indebtedness

The concept of controlled indebtedness was introduced by the Russian legislator to determine the tax base for corporate profits tax, if the company has a debt to a foreign company.

Since January 1, 2017, new rules on the accounting of debt obligations on controlled indebtedness entered into force.

Below is a comparative analysis of the changes.

Specific procedure for the account of interest will be applied, if the amount of the taxpayer’s controlled indebtedness is more than three times greater than the difference between the sum of assets and the value of liabilities of this taxpayer on the last day of the reporting (tax) period.

The exchange of information for tax purposes with the Russian Federation

The year 2016 was marked by the fight with the offshore capital. In this regard, a significant part of the changes in the Russian tax legislation touched precisely the implementation of legal instruments to ensure the transparency of the tax business.

During the year, Russia and other countries signed a number of agreements on the avoidance of double taxation. Some of these agreements have already been covered by our experts.

According to the results of the outgoing year, the tax authority has updated the list of states that do not carry out the exchange of tax information with Russia in the proper volume. It now has fewer jurisdictions – 109 countries and 19 territories (previously – 111 countries and 22 territories). Georgia, Estonia, Mauritius, Hong Kong, the Cayman Islands, Bermuda, Aruba were excluded. This list is supplemented by South Korea.

Current information on the existing agreements on the avoidance of double taxation is available on the official website of Korpus Prava.