Minorities of All Countries, Unite!

As it is known, in the system of corporate relations the central player is the shareholder. In fact, all corporate legislation is, to one degree or another, aimed at ensuring the shareholder’s rights for the development of a healthy corporate climate in Russia. Russian corporate legislation is currently experiencing a period of rapid development. Numerous innovations in the field of protection of the shareholders’ rights confirm this fact.

At the same time, special attention is paid to the relations between the shareholders themselves, and the balance of rights and legitimate interests of minority and majority shareholders is considered to be one of the most difficult problems of corporate relations.

It should be noted that the legislator does not provide for the division of shareholders into minority and majority shareholders. However, courts often resort to this definition in their decisions, noting that minority shareholders are a weak link in the system of corporate relations.

This article shall consider some aspects of the implementation of rights by minority shareholders.

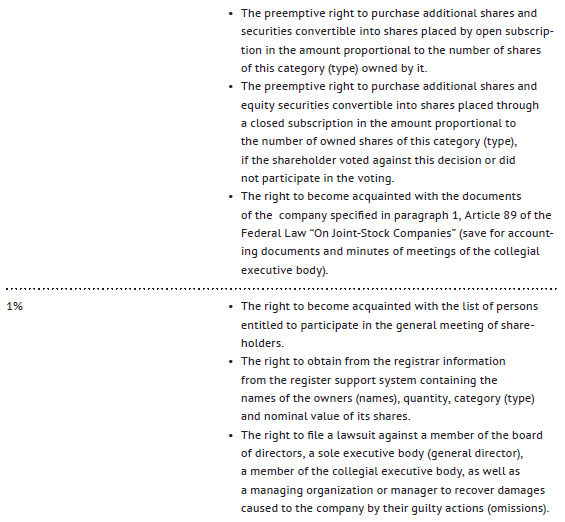

Analysis of the regulations of the federal legislation on joint-stock companies allows concluding that the limits of the shareholder’s authority directly depend on the amount of shares it holds. This is clearly shown in the table:

To date, the main body that controls compliance with the legislation in the field of the protection of the investors’ rights is the Bank of Russia.

Let us recall that on the financial market the Bank of Russia is a mega-regulator. In order to implement the functions for the protection of rights and legitimate interests of shareholders and investors on the financial markets, the Bank of Russia is vested with broad authorities with respect to issuers at the conduct of their activities on the financial markets and in the area of regulation of corporate relations in joint-stock companies. In particular, the Central Bank of the Russian Federation establishes requirements for the procedure of preparation, convocation and holding of a general meeting of shareholders, establishes a list of information mandatory for persons entitled to participate in the general meeting of shareholders and controls the acquisition of shares.

According to statistics provided by the Bank of Russia, 3 382 complaints concerning violations of federal legislation by issuers were submitted to the Service for the Protection of the Rights of Consumers of Financial Services and Minority Shareholders of the Bank of Russia during the period from II to IV quarter of 2016.

The main reasons for the appeals of shareholders were the following violations:

- Violation of the procedure for the disclosure of information by issuers;

- Failure to submit documents at the request of the shareholder;

- Failure to send a mandatory offer to acquire shares.

Violation of the procedure for the disclosure of information by issuers

In accordance with paragraph 1, Article 30 of the Federal Law “On the Securities Market”, the disclosure of information on the securities market means guaranteeing its availability to all interested persons, regardless of the purpose for obtaining this information in accordance with the procedure that guarantees its discovery and receipt.

Public joint-stock companies shall unconditionally disclose the following information:

- Annual report of the company;

- Annual accounting statements of the company;

- Prospectus of the company’s securities in cases provided for by legal acts of the Russian Federation;

- Notification of a general meeting of shareholders in accordance with the procedure provided for by this Federal Law;

- Other information determined by the Bank of Russia.

“Other information determined by the Bank of Russia” means, first of all, documents and information, the disclosure of which is provided for by the “Regulation on Disclosure of Information by Issuers of Equity Securities” (approved by the Bank of Russia on December 30, 2014 No. 454-P).

The specified information should be disclosed in the news line of at least one of the information agencies, which in due course are authorized to disclose information about securities and other financial instruments. Thus, the legislator ensures the access of the shareholder, as well as other interested parties, to general information on the activities of the joint-stock company.

The sanction for the violation of the procedure and deadlines for the disclosure of information is provided for by the Code of the Russian Federation on Administrative Offenses. For legal entities the fine for such violations is from seven hundred thousand to one million rubles.

Failure to submit documents at the request of the shareholder

Russian corporate law imposes the obligation to keep a list of documents specified by law on the joint-stock company. The company keeps the documents provided for by paragraph 1, Article 89 of the Federal Law “On Joint-Stock Companies” at the location of its executive body in the manner and within the time limits established by the Bank of Russia.

The company shall provide these documents within seven working days from the date of sending the relevant request. Violation of the time limits for the provision of documents by the joint-stock company also entails the imposition of an administrative fine in the amount of five hundred to seven hundred thousand rubles.

The procedure for sending a mandatory offer to minority shareholders within the framework of acquisition of large stakes deserves separate attention.

The process of acquiring large stakes is closely connected with the notion of a corporate control. The establishment of a special procedure related to the purchase of significant stocks of shares is due to the fact that the new owner actually establishes (or attempts to establish) corporate control over the joint-stock company. The change in corporate control could potentially affect the interests of a large number of individuals, including minority shareholders and members of the management bodies of the joint-stock company.

A mandatory offer is a public offer addressed to shareholders – owners of shares of the relevant categories (types), on the acquisition of shares of the open company owned by them.

A mandatory offer is addressed to anyone who responds to it. It is designed to protect the interests not of individual groups, but of all shareholders of the company. If the increase in the rights of corporate control by a person who has acquired a large stock of shares does not correspond to the economic interests of minority shareholders, they have the opportunity to leave the company and return their investments by accepting a public offer.

A mandatory offer to acquire shares in a joint-stock company, as well as other equity securities convertible into shares of an open company, is exercised in accordance with the procedure provided for by the law on joint-stock companies by a person who acquired more than 30% of the total number of shares of the company specified in paragraph 1, Article 84 of the Law “On Joint-Stock Companies”, taking into account the shares owned by this person and its affiliates.

The conflict of interests of shareholders and the investor arises in the event the purchaser of shares fails to fulfill the obligation to send a mandatory offer to the company, if the quantity of securities purchased by it exceeds 30 percent of the voting shares of the company.

Proceeding from the regulations of the current legislation, as a legal consequence of failure to fulfill the obligation to send a public offer by a person who has acquired more than 30 percent of the total number of shares of the open company, the law provides for limiting the number of shares by which such person and its affiliates are entitled to vote before the date of sending a mandatory offer.

At the same time, the legislator provides for certain thresholds of ownership, exceeding which the number of shares that a shareholder can vote changes (the one failed to fulfill the obligation to send a mandatory offer to redeem securities) – 30 percent, 50 percent and 75 percent, respectively.

Exceeding the threshold of 30 percent, but not reaching 50 percent, the shareholder can only vote by 30 percent of the shares before sending a mandatory offer.

Exceeding the threshold of 50, but not reaching 75 percent, the shareholder can only vote by 50 percent of the shares before sending a mandatory offer. A similar scheme applies when the threshold of 75% is exceeded.

Summarizing the foregoing, I believe that the modernization of the legislative framework, as well as the work of authorized state authorities in the sphere of regulation of corporate relations, gives its positive results. However, much remains to be done in order to resolve the issue of trust of the shareholders of Russian companies, both to issuers and to state executive bodies responsible for observing interests and protecting the rights of minority shareholders.