Революция реальная и воображаемая: громкие изменения трудового законодательства в 2014 году

Хотя в прошедшем году наиболее заметными и обсуждаемыми были реформы налогового законодательства, нельзя не отметить еще одну обращающую на себя внимание тенденцию. Законодатели приступили к активному реформированию одной из самых, пожалуй, статичных отраслей российского права – трудового. В этой статье вспомним наиболее значительные изменения, принятые в этой сфере, часть из которых уже вступила в силу, а часть – вступит в течение следующих лет.

Общие изменения трудового законодательства

Отмена «зарплатного рабства»: главная фикция года

Приз за главную фикцию 2014 года, если бы такая номинация была учреждена, должен был достаться закону, который, судя по громким заявлениям журналистов, отменил угнетающее большинство российских трудящихся «зарплатное рабство», когда работодатель, заключая с избранным по своему усмотрению банком договор об обслуживании так называемого «зарплатного проекта», принуждает работника получать заработную плату на открытый для него лицевой счет в этом банке. Для защиты работников от произвола работодателей было внесено изменение в статью 136 Трудового кодекса Российской Федерации, которая, как раньше казалось, была однозначной и ни в каких корректировках не нуждалась.

Законодатель предложил работникам прочувствовать разницу между двумя формулировками:

Что изменилось? Для перечисления заработной платы работника на банковский счет с него по-прежнему необходимо получить заявление. В отличие от действовавшей ранее нормы, теперь это заявление должно содержать не все реквизиты счета, а лишь наименование кредитной организации (не совсем, правда, понятно, каким образом работодатель сможет перечислить заработную плату, имея столь ограниченный объем сведений, но этот вопрос мы опустим как не относящийся к делу). Кроме того, работник теперь вправе заменить такую кредитную организацию, представив работодателю новое заявление. Что действительно можно считать новеллой трудового права, так это установление срока представления такого заявления, при соблюдении которого работник сможет получить следующую выплату по новым реквизитам. Такой срок составляет 5 рабочих дней1. Попробуем понять глубокие различия между старой и новой редакциями. Старая редакция требовала, чтобы в случае, если условиями трудового договора с работником или коллективного договора предусмотрена возможность перечисления заработной платы на банковский счет, реквизиты такого счета сообщались работником самостоятельно путем составления отдельного заявления. Не слишком удобный вариант, но, как мы видим, не предполагающий права работодателя самостоятельно выбирать кредитную организацию, через которую работники будут получать заработную плату. Даже если «зарплатный проект» существовал, это не отменяло право работника потребовать перечисления причитающейся ему заработной платы по другим реквизитам, в том числе и в другую кредитную организацию.

Запрет заемного труда

Слухи об этом изменении ходили достаточно давно. Заемный труд, чаще именуемый аутстаффингом, то есть предоставлением персонала, контролирующие и надзорные органы и так не жаловали, и при проведении проверок миграционного или санитарно-эпидемиологического законодательства признавали заказчиков услуг ответственными за деятельность аутстафферов. Хотя суды высших инстанций периодически встают на сторону заказчиков2, так называемая «аренда персонала» остается зоной риска для российских предпринимателей.

С 2016 года аутстаффинг в абсолютном большинстве случаев окажется вне закона. 5 мая 2014 года Президент России Владимир Путин подписал закон, запрещающий с 1 января 2016 года заемный труд, за исключением специально аккредитованных агентств по предоставлению персонала и юридических лиц, аффилированных с фактическими работодателями.

В трудовое законодательство внедряется понятие заемного труда – это труд, осуществляемый работником по распоряжению работодателя в интересах, под управлением и контролем физического лица или юридического лица, не являющихся работодателем данного работника3. Таким образом, под запретом оказываются услуги, обладающие в совокупности несколькими признаками:

- Лица, выступающие в качестве юридического и фактического работодателей, не совпадают.

- Работник в процессе трудовой деятельности подчиняется указаниям фактического работодателя, юридический работодатель исключен из процесса операционного взаимодействия работника и фактического работодателя.

- Фактический работодатель контролирует работу работника, и, как производный признак, работник в своей трудовой деятельности руководствуется правилами внутреннего трудового распорядка фактического, а не юридического работодателя.

- Работник выполняет свои трудовые функции у фактического работодателя по указанию юридического работодателя, а не по собственной инициативе.

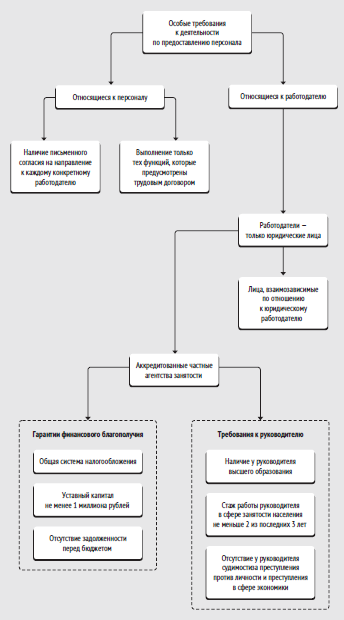

Если указанные выше признаки имеют место, то деятельность юридического работодателя должна соответствовать установленным законом требованиям и ограничениям. Такие ограничения, установленные законодательством о занятости населения, можно разделить на ограничения, касающиеся отношений с работниками, и дополнительные требования к работодателю4.

Итак, у предпринимателей, пользующихся услугами аутстафферов, есть год для того, чтобы принять решение, будут ли они продолжать использовать этот инструмент, и соответственно, подбирать организацию, которая будет соответствовать новым требованиям, либо, напротив, в течение того же года обеспечить, чтобы услуги, приобретаемые у сторонних организаций, не отвечали признакам «аренды персонала».

Изменения в правовом положении иностранных работников в России

Трудовой кодекс дополнен главой, регламентирующей особенности трудовых отношений с иностранными гражданами и лицами без гражданства

1 декабря 2014 года Президент России Владимир Путин подписал закон, предписывающий иностранным гражданам и лицам без гражданства при осуществлении трудовой деятельности в России самостоятельно приобретать или получать от работодателя гарантии предоставления первичной медико-санитарной и неотложной специализированной медицинской помощи5.

Закон также включил в перечень документов, которые должны быть предъявлены иностранным гражданином при приеме на работу в российскую организацию, кроме привычных документов, удостоверяющих личность, визы, разрешения на временное проживание или вида на жительство, а также разрешения на работу или патента, страховку, обеспечивающую предоставление работнику первичной медико-санитарной и неотложной специализированной помощи на территории России. Если у работника такой страховки нет, работодатель вправе заключить в его пользу договор на предоставление платных медицинских услуг, но как бы то ни было, иностранный работник или работник, не имеющий гражданства, при приеме на работу должен иметь гарантии предоставления ему минимально необходимого набора медицинских услуг6. При этом окончание срока действия медицинской страховки признано одним из оснований прекращения трудового договора с работником7.

Другими дополнительными основаниями расторжения трудового договора с иностранным работником признаны:

- Приостановление, окончание срока или аннулирование разрешения на привлечение и использование иностранных работников, выдаваемого работодателю.

- Окончание срока действия или аннулирование документа, обосновывающего право на проживание (временное пребывание) и (или) занятие работником трудовой деятельностью на территории Российской Федерации, выданного работнику.

- Приведение численности работников, являющихся иностранными гражданами и лицами без гражданства, в соответствие с установленными законодательством ограничениями.

- Невозможность предоставления работнику прежней работы по окончании срока временного перевода работника на другую работу, обусловленного исключительными случаями, ставящими под угрозу жизнь или нормальные жизненные условия всего или части населения, либо простоем.

- Невозможность временного перевода работника на другую работу в связи с тем, что в течение календарного года такой перевод уже производился8.

Два последних основания расторжения трудового договора с иностранными работниками связаны с еще одной важной нормой, введенной в Трудовой кодекс, регламентирующей право работодателя переводить иностранного работника на другую работу на срок, не превышающий одного календарного месяца, и не чаще одного раза в год в случаях наступления чрезвычайных ситуаций, угрожающих жизни или нормальным жизненным условиям населения. В указанных случаях работодатель вправе привлечь работника к трудовой деятельности, не указанной в его разрешении на работу или патенте9.

Смысл норм, введенных в трудовое законодательство в отношении иностранных работников, заключается в том, что, с одной стороны, официальный прием на работу таких лиц осложняется необходимостью представления работником медицинской страховки, с другой, сложности на этапе приема на работу компенсируются упрощенным порядком увольнения.

Представляется, что хотя попытки законодателя решить наболевшую миграционную проблему трудоправовыми средствами, несомненно, достойны всяческих похвал, сейчас они чрезвычайно осторожны и несмелы. Несмотря на это, если тенденция сохранится, возможно, официальный прием на работу низкоквалифицированной иностранной рабочей силы составит достойную конкуренцию неправовым методам.

С 1 января 2015 года введена аккредитация иностранных работников филиалов и представительств иностранных организаций на территории России

Аккредитация филиалов и представительств иностранных организаций, открываемых на территории Российской Федерации, стала привычной процедурой. До государственной регистрации таких обособленных подразделений в налоговом органе документы для проведения аккредитации подаются в Государственную регистрационную палату Минюста России, а в отношении представительств кредитных организаций – в Банк России.

С 1 января 2015 года вводится персональная аккредитация сотрудников филиалов и представительств иностранных юридических лиц10. Органами, осуществляющими аккредитацию, стали те же органы, которые несут ответственность и за аккредитацию соответствующих филиалов и представительств: Государственная регистрационная палата Минюста России для филиалов и представительств любых компаний, кроме кредитных организаций, и Банк России – для кредитных организаций.

Государственная регистрационная палата пока разместила на своем официальном сайте только информацию об аккредитации сотрудников представительств и членов их семей, очевидно, в недалекой перспективе и появление такой информации о сотрудниках филиалов. Так, Палата сообщила, что срок действия персональной аккредитации сотрудников и их семей будет ограничивается периодом действия выданного Палатой разрешения на деятельность представительства. Продление персональной аккредитации будет производиться при продлении срока аккредитации представительства.

В качестве подтверждения факта аккредитации иностранным сотрудникам и членам их семей выдаются аккредитационные карточки.

- Статья 136 Трудового кодекса Российской Федерации в редакции Федерального закона № 333-ФЗ от 04.11.2014.

- Например, в Постановлении № 18-АД13-36 от 24.12.2013 Верховный Суд Российской Федерации признал, что заказчик, проявивший должную осмотрительность при заключении договора о предоставлении персонала, не должен привлекаться к административной ответственности за нарушение миграционного законодательства работниками исполнителя.

- Статья 56.1 Трудового кодекса Российской Федерации в редакции Федерального закона № 116-ФЗ от 05.05.2014.

- Соответствующие требования предусмотрены статьей 18.1 Закона Российской Федерации № 1032-1 от 19.04.1991 «О занятости населения в Российской Федерации» в редакции Федерального закона № 116-ФЗ от 05.05.2014.

- Пункт 10 статьи 13 Федерального закона № 115-ФЗ от 25.07.2002 «О правовом положении иностранных граждан в Российской Федерации» в редакции Федерального закона № 409-ФЗ от 01.12.2014.

- Статья 327.3 Трудового кодекса Российской Федерации в редакции Федерального закона № 409-ФЗ от 01.12.2014.

- Пункт 8 части 1 статьи 327.6 Трудового кодекса Российской Федерации в редакции Федерального закона № 409-ФЗ от 01.12.2014.

- Статья 327.6 Трудового кодекса Российской Федерации в редакции Федерального закона № 409-ФЗ от 01.12.2014.

- Статья 327.4 Трудового кодекса Российской Федерации в редакции Федерального закона № 409-ФЗ от 01.12.2014.

- Статья 15.1 Закона Российской Федерации № 5340-1 от 07.07.1993 «О торгово-промышленных палатах в Российской Федерации» в редакции Федерального закона № 106-ФЗ от 05.05.2014.