Амнистия капиталов. Версия 2.0

В феврале 2018 году был принят и вступил в силу пакет законов, нацеленных на продление процедуры амнистии капиталов.

В частности, были приняты следующие законодательные акты, которые ознаменовали продолжение кампании по деофшоризации и амнистии российского капитала:

- Федеральный закон N 33-ФЗ от 19.02.2018 «О внесении изменений в Федеральный закон «О добровольном декларировании физическими лицами активов и счетов (вкладов) в банках и о внесении изменений в отдельные законодательные акты Российской Федерации» (далее — Закон N 33-ФЗ);

- Федеральный закон N 34-ФЗ от 19.02.2018 «О внесении изменений в части первую и вторую Налогового кодекса Российской Федерации и статью 3 Федерального закона «О внесении изменений в части первую и вторую Налогового кодекса Российской Федерации (в части налогообложения прибыли контролируемых иностранных компаний и доходов иностранных организаций)» (далее — Закон N 34-ФЗ);

- Федеральный закон N 35-ФЗ от 19.02.2018 «О внесении изменений в статью 76.1 Уголовного кодекса Российской Федерации» (далее — Закон N 35-ФЗ).

Первый этап амнистии продолжался с 01 июля 2015 года по 30 июня 2016 года. По итогам первого этапа можно наблюдать разделение аудитории налогоплательщиков (на которых ориентированы положения законодательства об амнистии, предоставляющие гарантии и преференции) на следующие группы:

- 1 группа: воспользовавшиеся гарантиями и подавшие специальные декларации в рамках 1-го этапа (по данным различных открытых источников, количество декларантов составило от 2,5[1] до 7,2[2] тысяч человек);

- 2 группа: радикально настроенная группа налогоплательщиков, которые отказались предоставлять сведения о себе и своем имуществе в рамках деофшоризации, и более того – сменили свое налоговое резидентство, покинув Российскую Федерацию (в середине 2017 года агентство Reuters сообщало, что проводимая в России политика деофшоризации приносит противоположные результаты, и ряд крупнейших бизнесменов после вступления в силу «Закона о деофшоризации» перестали быть налоговыми резидентами России. Ссылаясь на источник, близкий к Кремлю, агентство сообщало тогда, что, по его оценкам, примерно третья часть из 500 самых богатых российских бизнесменов покинула страну с момента принятия закона о деофшоризации);

- 3 группа: оставшаяся часть (большинство) налогоплательщиков, которые заняли выжидательную позицию, руководствуясь принципом «инициатива наказуема», и не стали использовать предлагаемые государством гарантии и освобождения.

Одним из доводов третьей группы лиц была твердая уверенность в том, что инструмента получения информации из-за рубежа у российских контролирующих органов не появится, механизмы автоматического обмена информации не заработают, а в итоге все останется на своих местах.

Однако в текущих условиях, когда:

- в РФ начала разрабатываться законодательная база, опосредующая интеграцию в процессы автоматического обмена;

- готовность предоставлять информацию в адрес российских налоговых органов в рамках автоматического обмена подтвердили более 70 государств (путем подписания двусторонних соглашений);

- полным ходом ведутся работы по разработке и интеграции программного обеспечения, позволяющего России присоединиться к автоматическому обмену информацией, уже не остается никаких сомнений в несостоятельности доводов и надежд налогоплательщиков, примкнувших к третьей группе.

Рассмотрим ключевые моменты и особенности подачи деклараций, установленные новыми поправками.

Что можно отразить в специальной декларации?

По-прежнему, как и в рамках первого этапа, в специальной декларации можно отразить сведения:

- Об имуществе, собственником или фактическим владельцем которого на дату представления декларации является декларант, в том числе о:

- земельных участках, других объектах недвижимости;

- транспортных средствах;

- ценных бумагах, в том числе акциях, а также долях участия и паях в уставных (складочных) капиталах российских и (или) иностранных организаций;

- О контролируемых иностранных компаниях, в отношении которых декларант на дату представления декларации является контролирующим лицом (в случае косвенного или скрытого участия в уставном капитале такой компании).

- О счетах (вкладах) физического лица в банках, расположенных за пределами Российской Федерации.

- О счетах (вкладах) в банках, если на дату представления декларации декларант признается бенефициарным владельцем счета (вклада).

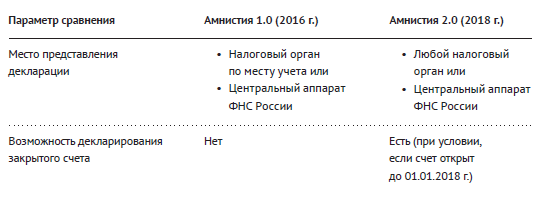

Новшеством в отношении объектов декларирования является получение возможности задекларировать зарубежные счета, не только открытые на дату подачи декларации (как было раньше), но и счета, уже закрытые к моменту подачи такой декларации. Единственное условие – счета должны были быть открыты до 01.01.2018 г.

Кто может подать специальную декларацию?

Специальную декларацию может подать любое физическое лицо, вне зависимости от его гражданства и налогового резидентства. При этом представление специальной декларации в рамках первого этапа не препятствует возможности подачи специальной декларации в рамках второго этапа. Декларация может быть представлена декларантом лично либо через уполномоченного представителя, действующего на основании нотариальной доверенности. При этом законом не предусмотрена возможность отправки такой декларации по почте.

Куда представляется декларация?

В соответствии с принятыми нововведениями декларация может быть предоставлена по выбору декларанта в любой налоговый орган (ранее речь шла о налоговом органе по месту жительства/учета декларанта) либо в центральный аппарат ФНС России.

Срок предоставления специальной декларации

Специальная декларация в рамках второго этапа амнистии может быть предоставлена в срок с 01 марта 2018 года до 28 февраля 2019 года.

Какие гарантии предоставляются при подаче специальной декларации?

Гарантии, предоставляемые декларанту, состоят в освобождении от уголовной, административной и налоговой ответственности по ряду преступлений/правонарушений, совершенных в ходе приобретения, использования или распоряжения имуществом и (или) контролируемыми иностранными компаниями, а также в ходе зачисления денежных средств на банковские счета (вклады).

Освобождение от уголовной ответственности касается следующих преступлений:

- уклонение от исполнения обязанностей по репатриации денежных средств в иностранной валюте или валюте Российской Федерации (статья 193 Уголовного кодекса РФ);

- уклонение от уплаты таможенных платежей, взимаемых с организации или физического лица, совершенное в крупном размере (части 1 и 2 статьи 194 Уголовного кодекса РФ);

- уклонение от уплаты налогов и (или) сборов с физического лица (статья 198 Уголовного кодекса РФ);

- уклонение от уплаты налогов и (или) сборов с организации (статья 199 Уголовного кодекса РФ);

- неисполнение обязанностей налогового агента (статья 199.1 Уголовного кодекса РФ);

- сокрытие денежных средств либо имущества организации или индивидуального предпринимателя, за счет которых должно производиться взыскание налогов и (или) сборов (статья 199.2 Уголовного кодекса РФ).

Освобождение от административной ответственности ограничено следующими составами административных правонарушений:

- осуществление предпринимательской деятельности без государственной регистрации или без специального разрешения/лицензии (статья 14.1 Кодекса об административных правонарушениях РФ);

- осуществление незаконных валютных операций по задекларированным зарубежным счетам (часть 1 статьи 15.25 Кодекса РФ об административных правонарушениях);

- представление резидентом в налоговый орган с нарушением установленного срока (или непредставление в установленный срок) уведомления об открытии (закрытии) счета (вклада) или об изменении реквизитов счета (вклада) в банке, расположенном за пределами территории Российской Федерации (части 2, 2.1 статьи 15.25 Кодекса РФ об административных правонарушениях).

Кроме прочего, декларант освобождается от налоговой ответственности за:

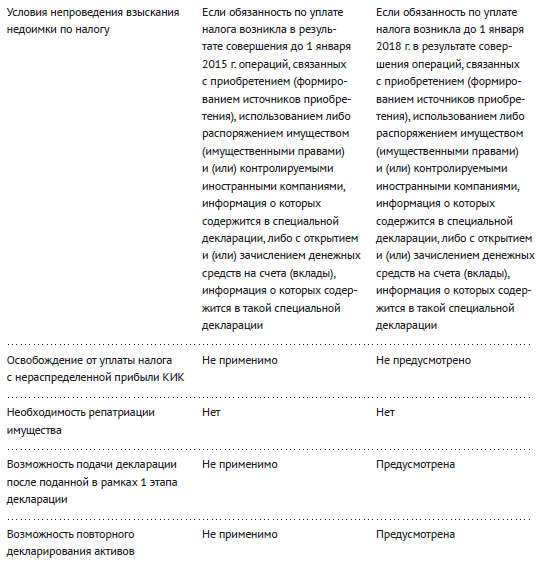

- неуплату налога, если обязанность по уплате такого налога возникла у декларанта и (или) иного лица до 1 января 2018 года в результате совершения операций, связанных с приобретением, использованием или распоряжением имуществом и (или) контролируемыми иностранными компаниями, за неподачу уведомлений об участии в иностранной компании и о контролируемой иностранной компании, а также зачислением денежных средств на банковские счета (вклады), сведения о которой содержатся в специальной декларации;

- нарушение срока подачи уведомления о контролируемых иностранных компаниях (часть 1 статьи 129.6 Налогового кодекса РФ);

- нарушение срока подачи уведомления об участии в иностранных организациях (часть 2 статьи 129.6 Налогового кодекса РФ).

Особенности предоставления гарантий

Следует учесть, что гарантии в отношении освобождения от уплаты налога (взыскания недоимки) не распространяются на освобождение от уплаты налогов с нераспределенной прибыли контролируемой иностранной компании.

Также необходимо понимать, что взысканию не подлежит недоимка, которая была образована до 01.01.2018 г. С учетом того, что срок по уплате налога (НДФЛ) истекает 15 июля года, следующего за годом получения физическим лицом дохода, физическое лицо в рамках амнистии может получить освобождение от уплаты налога по доходам, полученным им не позднее 31.12.2016 г. Если доход был получен им в течение 2017 года, то обязанность по декларированию и уплате налога возникла уже в 2018 году – соответственно, на такие операции гарантии распространяться не будут.

В отношении освобождения от ответственности за совершение незаконных валютных операций по зарубежным счетам, сведения о которых присутствуют в декларации – как и раньше, все операции по таким счетам, совершенные до даты подачи декларации, признаются законными.

Основные отличия второго этапа амнистии от первого представлены в таблице ниже:

Продление безналоговой ликвидации

Одновременно с продлением процедуры амнистии законодателем также была продлена иная, тесно связанная с деофшоризацией процедура – безналоговая ликвидация контролируемых иностранных компаний.

Указанная процедура позволяет без каких-либо негативных налоговых последствий для контролирующего лица ликвидировать контролируемую иностранную компанию и получить активы такой компании. При этом получение таких активов не признается доходом физического лица для целей налогообложения, а при последующей продаже таких активов физическим лицом можно применить налоговый вычет (в виде уменьшения налоговой базы на стоимость активов, определенную по данным бухгалтерского учета ликвидированной КИК на дату ликвидации).

Ранее предельный срок для ликвидации КИК и получения активов в безналоговом порядке был установлен до 01.01.2018 г.

Принятые изменения продлевают данную процедуру до 01.03.2019 г.

Кроме того, если раньше льгота по безналоговой ликвидации распространялась только на имущество, за исключением денежных средств, то теперь денежные средства также признаются активом, который может быть получен контролирующим лицом в безналоговом порядке при ликвидации КИК.

Безусловно, принятые поправки расцениваются нами как положительные, поскольку расширяют возможности налогоплательщиков по использованию гарантий и компенсаций. Тем не менее целесообразность участия во втором этапе амнистии, а также использования процедуры безналоговой ликвидации может быть определена исключительно после подробного анализа и оценки таких факторов, как: структура активов, история и механизм их приобретения, наличие и оценка рисков привлечения к ответственности и многих других.

[1]https://www.vedomosti.ru/economics/articles/2017/12/22/746232-amnistiyu-kapitalov.

[2]https://www.rbc.ru/newspaper/2018/02/01/5a71d7fd9a79470410e91497.