- Подробный гайд: корпоративный налог в ОАЭ

- Оборотные штрафы за утечки персональных данных в России 2024

- НДФЛ после приостановления СОИДН. Анализ на примере Кипра

- О добровольном раскрытии информации о КИК налоговыми нерезидентами РФ

- Закон об ускоренном гражданстве для иностранных граждан на Кипре. Вторая поправка

- Доходы иностранцев в России в 2024 году

- Изменения в налоговом поле Кипра. Выпуск №4

- НДС в ОАЭ

Уголовная ответственность за преступления в сфере предпринимательской и иной экономической деятельности

Настоящим законодательством совершение любого преступления карается уголовным наказанием. Однако степень общественной опасности у преступлений различна: одни преступления посягают на жизнь и здоровье человека, а их последствия часто невозможно возместить, другие – посягают на экономические интересы государства и собственность, и причиненный такими преступлениями ущерб можно компенсировать.

По причине различного характера преступлений российским уголовным законодательством предусмотрена статья 76.1 УК РФ об освобождении от уголовной ответственности по делам о преступлениях в сфере экономической деятельности.

Данная норма является компромиссной, поскольку позволяет лицу, совершившему преступление, избежать уголовной ответственности и получить смягчение наказания путем совершения постпреступных действий, направленных на возмещение причиненного ущерба.

Вышеупомянутая норма Уголовного кодекса введена в рамках общей концепции гуманизации уголовной политики Федеральным законом РФ от 7 декабря 2011 года №420-ФЗ «О внесении изменений в Уголовный кодекс РФ и отдельные законодательные акты РФ». Статья 76.1 УК РФ предусматривает освобождение лиц, впервые совершивших преступление в сфере экономической деятельности, если причиненный преступными действиями ущерб возмещен в полном объеме.

Потребность в данной норме существовала задолго до её появления, тем не менее сегодняшние реалии диктуют недостаточность данной нормы. Так, 13 декабря 2017 года в Совете Федерации происходило обсуждение гуманизации уголовного законодательства, в рамках которого предлагалось смягчение санкций за преступления небольшой и средней тяжести путем возмещения материального ущерба пострадавшим от преступлений. В том числе была предложена декриминализация преступлений, связанных с осуществлением предпринимательской и иной экономической деятельности. Например, это преступления, которые были совершены вследствие ошибки при ведении экономической деятельности и которые не несут опасности для общества.

Эксперты, выступившие 13 декабря в Совете Федерации с докладом, проанализировав приговоры по таким статьям, как ст. 22 УК РФ (преступления в сфере экономической деятельности), ст. 159 УК РВ (мошенничество), ст. 160 УК РФ (присвоение или растрата, совершенные с использованием служебного положения), выяснили, что в подавляющем большинстве приговоров допущенные предпринимателями ошибки не несли общественной опасности, а соответственно, нет необходимости в уголовной репрессии.

Стоит отметить, что шаг на пути к декриминализации экономических преступлений был успешно реализован в 2016 году: Государственная Дума РФ приняла законопроект о частичной декриминализации экономических преступлений.

Были внесены такие изменения, как увеличение минимального размера ущерба для возбуждения уголовных дел по делам об экономических преступлениях, поскольку данные минимальные значения не менялись с начала 2000-х годов и не соответствуют настоящим реалиям. Также вдвое была увеличена минимальная сумма неуплаченных налогов и сборов для возбуждения уголовного дела о налоговых преступлениях – с 1,8 млн до 2,7 млн рублей. Были внесены поправки и в Уголовно-процессуальный кодекс РФ, которые позволяют подозреваемому или обвиняемому с момента ареста или домашнего ареста иметь право на неограниченные по времени и количеству свидания с нотариусом для оформления доверенности на право представления интересов в сфере предпринимательской деятельности.

В том числе благодаря законопроекту были снижены санкции части 4 статьи 180 Уголовного кодекса РФ за незаконное использование средств индивидуализации товаров, работ или услуг, совершенное группой лиц по предварительному сговору.

Крайняя необходимость декриминализации экономических преступлений состоит в том, что они являются «хлебом» для правоохранительных органов. На данный момент сложилась ситуация: когда человек выбирает между регистрацией предприятия и нелегальной экономической деятельностью – он выбирает второе, поскольку привлечь за ведение бизнеса «в тени» гораздо сложнее, нежели когда предприниматель находится в постоянном поле зрения правоохранительных органов. Соответственно, декриминализация экономических преступлений позволит в том числе прекратить злоупотребления правоохранителей.

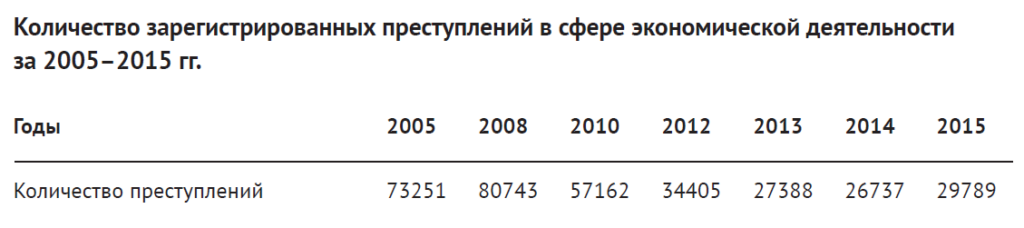

Есть и противоположное мнение на этот счет. Так, анализ правоприменительной практики свидетельствует, что обвинение правоохранительных органов в излишнем давлении является не вполне обоснованным. Например, статистика подтверждает, что за последнее десятилетие количество преступлений в сфере предпринимательской и иной экономической деятельности снизилось на 60%.

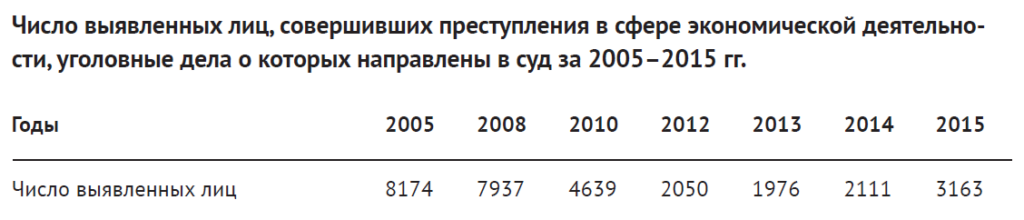

Также уменьшилось количество лиц, совершивших преступления в сфере экономической деятельности, чьи уголовные дела дошли до суда, на 61%.

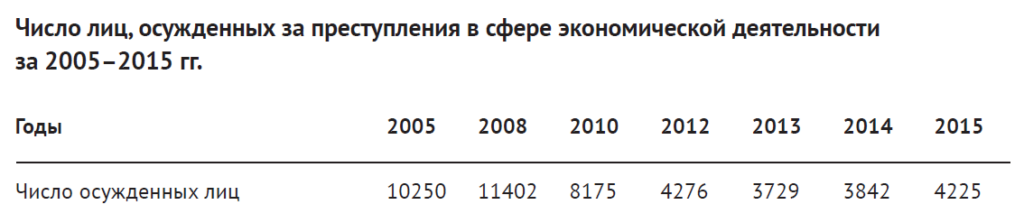

Путем анализа судебной практики приходим к выводу, что число лиц, осужденных за преступления в сфере экономической деятельности, уменьшилось на 58,8%.

Анализ судебной практики на предмет вынесения приговоров по таким делам дает понять, что судьи выносят приговоры с достаточно либеральным подходом. Так, от общего числа осужденных за экономические преступления в 2015 году наказание в виде лишения свободы получили только 17% осужденных.

Тем не менее, как было сказано выше, доработки законодательства в области уголовных правонарушений требуются. Видится необходимость в большей декриминализации преступлений в сфере предпринимательской и иной экономической деятельности.

Поскольку в настоящий момент Совет Федерации готовит новую концепцию уголовной политики России, то стоит надеяться на гуманизацию уголовного законодательства.