Закат налогового туризма

Последнее десятилетие мы можем наблюдать общемировую тенденцию по борьбе с уклонением от уплаты налогов. Если раньше план BEPS (Base erosion and profit shifting), вышедший из-под пера Организации экономического сотрудничества и развития (ОЭСР), выглядел неубедительно, а многие пункты казались невыполнимыми, то сейчас мы видим, как многие юрисдикции, в том числе те, от которых этого совсем не ожидали, с большим энтузиазмом вчитываются в этот план и пытаются имплементировать его в своей реальности.

Органы налогового контроля обзаводятся разнообразными инструментами для выявления и контроля слишком творческих налогоплательщиков. Так, например, одним из самых эффективных инструментов является международный автоматический обмен налоговой информацией, при этом изящность этого инструмента заключается в том, что ответственными за первоначальный сбор информации сделали финансовые организации (в частности, банки), которые как никто другой, как правило, отлично осведомлены о своих клиентах, их деятельности, источниках денежных средств, доходах, управляющих по счету, лицах, осуществляющих управление бизнесом, и лицах, назначенных в качестве номинального управляющего. В некоторых случаях существенную информацию предоставляет клиентский менеджер, содержащий данные личного характера, бережно собранные за годы работы с клиентом исключительно с целью улучшения качества обслуживания.

Сейчас, работая с банком, компания обязана предоставлять максимум информации о своей деятельности – не формальным заполнением анкеты клиента, а подтверждая всё документами. Раньше компания по умолчанию считалась налоговым резидентом той юрисдикции, в которой зарегистрирована, самые вдумчивые запрашивали сертификат налогового резидентства. Около пяти лет назад банк не задавал вопросы о месте ведения бизнеса, месте проживания директора, подтверждении квалификации директора (а если директор не выглядит достаточно квалифицированным, то о лице, принимающем ключевые решения). Не обращали внимание, скажем, на адрес электронной почты управляющего по счету (ну и что, что он .ru?), номер телефона и уж тем более не смотрели на всё это в комплексе с целью проанализировать всю структуру управления и определить налоговое резидентство компании.

Помимо все прочего, у банков появились черные списки юрисдикций, с которыми они не работают по причине высокого риска. Таким образом, если приходит клиент, владеющий компанией, зарегистрированной, например, на Маршалловых островах, то сотрудник банка смотрит в свою инструкцию, рисковую матрицу и видит, что эта юрисдикция находится в черном списке, и в открытии счета клиенту будет отказано.

Включение банком той или иной юрисдикции в черный список может быть связано с разными причинами – как политическими, так и экономическими. Например, государственные органы юрисдикции инкорпорации компании не обеспечивают должный уровень контроля за своими налогоплательщиками (нет требования по ведению отчетности, изменения в составе акционеров указываются только в реестре, который ведет секретарь компании).

В свете вышесказанного одним из трендов современности стал так называемый real substance или economic substance (на русский язык можно перевести как «реальное присутствие, экономическая сущность»; в Налоговом кодексе РФ, например, этот феномен нашел свое отражение в термине «фактический получатель дохода»). Если максимально упростить разъяснения, то критерий «экономический сабстанс» указывает на наличие либо отсутствие реальной экономической деятельности (оно же экономическое присутствие) компании на территории конкретной юрисдикции.

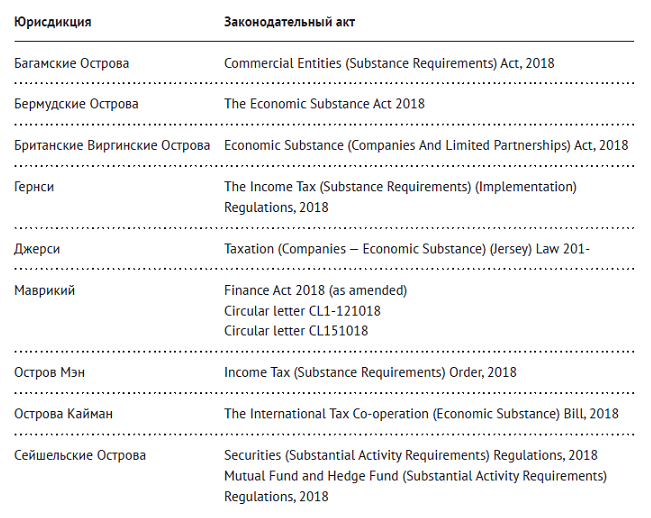

Требование об экономическом присутствии дошло туда, куда многие не ожидали что оно даже заглянет, а именно в офшоры. В частности, Белиз, Сейшельские Острова, Маврикий, Каймановы острова, Бермудские острова, Джерси, Гернси и остров Мэн – здесь приняли законы об экономическом содержании (Economic Substance Law). Ниже приведена таблица с указанием законодательных актов.

Закон об экономическом сабстансе вводит требования к экономическому присутствию для всех компаний и товариществ с ограниченной ответственностью, которые зарегистрированы и являются налоговыми резидентами указанных юрисдикций.

Так, в нынешнем году компании и партнерства должны будут определиться со своим статусом налогового резидентства. Чтобы стать налоговым резидентом офшорной юрисдикции компании необходимо подтвердить экономическую активность на территории офшора и соответствовать требованиям, установленным в законе.

Однако не все компании и партнерства обязаны подтверждать статус налогового резидентства офшора.

Компании, на которые распространяется действие закона и которые должны иметь обеспечивать экономическое присутствие, – это те, которые осуществляют «соответствующую деятельность», например:

- финансовые компании (банковский бизнес, страховой бизнес, биржи);

- судоходный бизнес (шиппинговые компании);

- холдинговый бизнес;

- бизнес в сфере интеллектуальной собственности;

- дистрибьюторский и сервисный бизнес.

Субъектами, не попадающими по действие закона, признаются компании, заявившие себя налоговыми резидентами другой юрисдикции, либо компании, осуществляющие деятельность, отличную от поименованной в «соответствующей».

Требования, предъявляемые к экономическому присутствию компаний, относительно абстрактны. Предполагается, что практика покажет, каковы критерии в числовых значениях. Сейчас указаны следующие требования:

- штат сотрудников в количестве, соответствующем масштабу бизнеса компании, при этом сотрудники должны иметь образование и опыт, который необходим для выполнения их трудовых обязанностей, соответствующих заявленной основной деятельности компании;

- наличие офиса, необходимого для размещения штата сотрудников и осуществления бизнеса компании (можно предположить, что речь идет не только об аренде помещения, но и о рабочих местах, оборудованных оргтехникой, телефонной связью, Интернет-соединением);

- ведение бухгалтерского учета и подготовка финансовой отчетности на регулярной основе (очевидна необходимость назначения ответственного лица, выполняющего эту функцию и имеющего соответствующую квалификацию);

- расходы, которые несет компания, должны быть адекватны деятельности, которую ведет компания, и по объему, и по существу (предположительно это означает, что расходы должны быть направлены на получение прибыли и соответствовать заявленному основному виду деятельности компании).

Конечно, здесь возникает вопрос – кто будет администрировать сбор информации об экономическом присутствии компании?

На примере БВО: закон требует, чтобы каждый поставщик корпоративных услуг (регистрационный агент), регистрирующий компанию, подпадающую под действие Закона, имел информацию, о том, где компания является налоговым резидентом, и должен быть готов передать эту информацию компетентным органам соответствующей юрисдикции. Так, информация о компаниях, заявляющих себя резидентами БВО (о штате сотрудников на БВО и за пределами, финансовая отчетность, адрес офиса и т.п.), будет хранится в электронной системе Beneficial Ownership Secure Search System (BOSSs).

Зарегистрированные компании и партнерства имеют обязательства в отношении экономического присутствия к 30 июня 2019 года. Если компания осуществляет одну из «соответствующих деятельностей», то такая компания должна сообщить об этом своему регистрационному агенту и предоставить ему информацию о выполнении требований в отношении экономического присутствия. Информацию нужно подать до 30 июня 2020 года, и впоследствии ее нужно будет обновлять ежегодно. На данный момент пока не утверждены конкретные требования в отношении этой информации, и пока неизвестно, насколько детально компании будут обязаны описывать выполнение ими требований об экономическом присутствии.

Регистрационный агент будет загружать полученные данные в информационную систему BOSSs. Доступ к этим сведениям будет иметь налоговый орган БВО (International Tax Authority, ITA), который и будет контролировать полноту и актуальность полученных данных и отправлять дополнительные запросы компаниям. Информация также может быть передана компетентным органам иностранной юрисдикции, например, в случае если компания, зарегистрированная на БВО, заявила, что она является налоговым резидентом такой иностранной юрисдикции.

Новые компании на БВО теперь возможно будет зарегистрировать только при соблюдении всех требований, предъявляемым к экономическому присутствию.

Юридические лица, которые не выполнят новые требования, будут вычеркнуты из Реестра компаний (Register of Companies), или Реестра партнерств с ограниченной ответственностью (Registerof Limited Partnerships). За нарушения закона будет налагаться штраф, минимальный размер которого составляет 5 000 долларов США. В случае неуплаты этого штрафа начнет действовать каскадная система увеличения размера штрафов. Некоторые нарушения могут повлечь за собой уголовную ответственностью в виде лишения свободы сроком до пяти лет. Требования ITA и штрафы можно будет обжаловать в судебном порядке.

Логично предположить, что со временем, по мере применения новых закона, тексты нормативно-правовых актов о реальном присутствии будут дорабатываться, появятся более детальные требования, разъяснения и методические указания, снижающие возможность бизнеса спрятаться за формально минимальным соблюдением пока еще не четко сформулированных требований. Однако, открытым остается вопрос о возможностях и ресурсах местной инфраструктуры. Статистика из различных доступных источников говорит о том, что компаний, которым необходимо привести свою деятельность в соответствие с новыми требованиями, предъявляемыми законом, значительно превышает возможности юрисдикций, в которых они зарегистрированы (речь в том числе идет о сотрудниках, офисных помещениях и т.п.).

Принимая во внимание вышеизложенное, бизнесу необходимо пересмотреть структуру капитала и оценить необходимость и стоимость содержания компаний в офшорных юрисдикциях, потому как в большинстве случаев стоимость содержания компании, соответствующей признакам реального экономического присутствия, будет нивелировать бенефиты, получаемые в связи с налоговой экономией. Возможно, стоит обратить внимание на другие юрисдикции, где инфраструктура позволяет обеспечить экономическое присутствие по более низкой стоимости, а налоговая нагрузка все еще низкая.