Аудит по российским и международным правилам

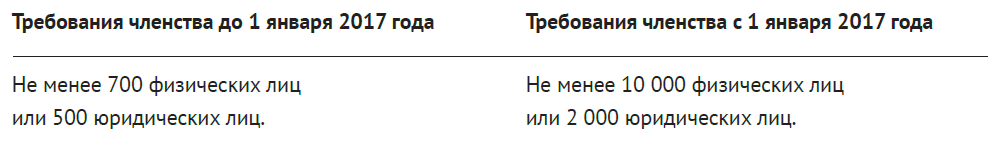

Два последних года были очень сложным периодом для аудиторского сообщества. Это связано с реформами относительно требований к членству в саморегулируемых организациях аудиторов, число участников которых увеличено теперь в несколько раз.

Напомним, что членство в саморегулируемой организации аудиторов является обязательным требованием для осуществления своей деятельности индивидуальным аудитором и аудиторскими организациями.

До декабря прошлого года существовала угроза монополизации аудиторского рынка путем создания одной единой саморегулируемой организации, подконтрольной Минфину РФ. К счастью, этого не произошло. Контроль над деятельностью аудиторов остается в сфере деятельности двух саморегулируемых организаций.

Прошедший год стал годом перемен для российского аудита и в части стандартов аудиторской деятельности. В конце 2016 года аудиторы следили за процессом утверждения «Международных стандартов аудита на территории РФ» и гадали, успеют ли законодатели перевести стандарты с английского языка, осуществить экспертизу и ввести в действие новые правила до конца года. Законодатели успели – с 1 января 2017 года вступают в силу 48 международных стандартов аудита, что налагает на аудиторов дополнительные обязательства.

В связи с введением в действие международных стандартов аудиторам предстоит немалая работа по пересмотру порядка и принципов деятельности в ходе проведения аудиторских проверок и сопутствующих аудиту услуг.

Однако стоит отметить, что, вводя в действие международные стандарты, законодатели позаботились об аудиторах и разрешили им в переходный период (2017 год) проводить аудит по действующим российским стандартам аудиторской деятельности, при условии заключения договора на аудит в 2016 году.

На самом деле ажиотаж вокруг международных стандартов аудита начался еще в середине 2015 года, когда Минфин РФ признал такие стандарты применимыми для российской действительности, но окончательное утверждение международных стандартов произошло только осенью 2016 года.

По своей сути федеральные стандарты аудиторской деятельности, применяемые по сей день, были разработаны в соответствии с международными правилами, существовавшими в начале 2000-х годов. Однако текст Международных стандартов в течение прошедших лет был существенно пересмотрен и стал во многом отличаться от российских стандартов.

Цели реформ

Основные цели введения «Международных стандартов аудита на территории Российской Федерации» – улучшение качества российского аудита и повышение эффективности взаимодействия аудитора и собственников бизнеса.

Понимание собственниками бизнеса целей и назначения аудиторской проверки всегда являлось большой проблемой как в российской, так и в международной практике. В российской действительности аудитор часто воспринимается руководством и собственниками своих клиентов как ревизор, приходящий с целью дискредитировать бухгалтерию и руководство, хотя деятельность аудитора преследует иные цели. Аудитор действует не в интересах налоговых или государственных органов, а в интересах общественности, целью аудитора является обеспечение понимания собственниками проблем и рисков своего бизнеса.

В соответствии с российским законодательством аудит – это проверка, проводимая с целью выражения мнения о достоверности отчётности. На практике аудитор не только проводит проверку бухгалтерской отчетности, но и указывает руководству на ошибки и риски, выявленные в ходе аудита, а также предлагает методы исправления таких ошибок и пути минимизации выявленных рисков.

Хочется верить, что с введением Международных стандартов аудита проблема непонимания руководством и собственниками бизнеса целей проведения аудита будет решена.

Кому предоставляется информация при проведении аудита по международным стандартам?

Одним из самых важных стандартов для заказчиков аудиторских услуг является МСА 260 «Информационное взаимодействие с лицами, отвечающими за корпоративное управление».

Этот стандарт полностью посвящен порядку взаимодействия аудитора и лиц, отвечающих за корпоративное управление, а именно – порядку получения от таких лиц информации и информирование таких лиц о планировании, целях, ходе проведения и результатах аудита.

Лица, отвечающие за корпоративное управление – лицо (лица) или организация (организации), которые несут ответственность за надзор за стратегическим направлением деятельности организации и имеют обязанности, связанные с обеспечением подотчетности организации. К таким обязанностям относится надзор за составлением финансовой отчетности.

Руководство – лицо или лица, наделенные исполнительными полномочиями и отвечающие за осуществление организацией своей деятельности.

То есть международные стандарты четко разделяют понятия «руководство организации» и «лица, отвечающие за корпоративное управление».

Теперь в обязанности аудитора в обязательном порядке входит информирование лиц, отвечающих за корпоративное управление, на этапе планирования и после завершения аудиторской проверки.

Так, на этапе планирования аудитор должен предоставить следующую информацию (в международной практике предоставление информации на этапе планирования аудиторской проверки предоставляется в форме Меморандума о стратегии аудита):

- цели аудита;

- особенности аудиторского задания;

- понимание бизнеса (отрасль, основные бизнес-риски);

- краткая информация о запланированном объеме и сроках проведения аудита, об имени, функциях, компетентности и обязанностях руководителя аудиторского задания;

- информирование о возможности модификации мнения в случае обнаружения существенных искажений;

- потребность в информационном взаимодействии с третьими лицами;

- заявление об ответственности руководства и лиц, отвечающих за корпоративное управление за финансовую (бухгалтерскую) отчётность аудируемого лица.

- форма и сроки ожидаемого взаимодействия с руководством и лицами, отвечающими за корпоративное управление (планируются даты обсуждений стратегии аудита, результатов аудита и промежуточных встреч, при необходимости).

В случае, если ценные бумаги заказчика аудиторских услуг допущены к организованным торгам (листинговые компании), аудитор также предоставляет:

- информацию о ключевых вопросах аудита (наиболее значимые области аудита);

- заявление о соблюдении аудитором Кодекса этики в части независимости аудитора, аудиторской группы и аудиторской организации в целом.

В Меморандуме о стратегии аудита аудитор предоставляет свое видение процесса аудита, предупреждает заказчика о возможности модификации мнения в определенных ситуациях и его ответственности о составленной бухгалтерской отчётности, а также о других важных условиях проводимой проверки.

Указанный документ призван обеспечить понимание лицами, отвечающими за корпоративное управление, процесса и целей проводимого аудита.

По результатам аудиторской проверки (до выдачи аудиторского заключения) лицам, отвечающим за корпоративное управление, предоставляется следующая информация:

- мнение аудитора о значительных качественных аспектах учетной практики организации, включая оценочные значения и раскрытие информации в финансовой отчетности;

- о значительных недостатках в системе внутреннего контроля, выявленных в ходе аудита, в том числе описание недостатков и пояснение их возможного воздействия, описание порядка анализа системы внутреннего контроля;

- значимые вопросы, которые возникли в ходе аудита и которые обсуждались или были предметом переписки с руководством;

- письменные заявления, запрашиваемые аудитором у руководства организации;

- обстоятельства, влияющие на форму и содержание аудиторского заключения,если такие имеются (планируемая модификация мнения, важные обстоятельства, прочие сведения);

- выявленные события или условия, которые могут вызвать значительные сомнения в способности организации продолжать непрерывно свою деятельность, а также раскрытие такой информации в финансовой (бухгалтерской) отчетности;

- прочие значимые вопросы, возникшие в ходе аудита, которые, согласно профессиональному суждению аудитора, имеют значение для надзора за процессом подготовки финансовой отчетности.

Таким образом, лица, отвечающие за корпоративное управление, узнают информацию напрямую от аудитора, и руководство заказчика не имеет возможности скрыть от них выявленные нарушения.

Также в ходе аудита могут возникнуть ситуации, в которых информирование лиц, отвечающих за корпоративное управление, осуществляется незамедлительно. Примером таких ситуаций может служить обнаружение доказательств наличия недобросовестных действий со стороны руководства или фактов несоблюдения законов и нормативных актов.

Главной идеей МСА 260 является то, что аудитор, как и ранее, имеет право запрашивать информацию не только у руководства заказчика, но и у лиц, отвечающих за корпоративное управление, но при этом информирование лиц, отвечающих за корпоративное управление, становится обязанностью аудитора.

Необходимость системы внутреннего контроля

При проведении аудита аудитор часто сталкивается с тем, что в организациях-заказчиках не разрабатывается система внутреннего контроля, а в некоторых случаях руководители и лица, отвечающие за корпоративное управление, даже не понимают, что это за система.

С введением международных стандартов аудитор не только должен проанализировать надежность и эффективность работы системы внутреннего контроля, налаженной организацией-заказчиком, но и указать результаты такого анализа в аудиторском заключении.

Итак, что же такое система внутреннего контроля?

Система внутреннего контроля – это процессы, разработанные, внедренные и поддерживаемые лицами, отвечающими за корпоративное управление, руководством и другими сотрудниками организации для обеспечения разумной уверенности в отношении достижения целей организации в области подготовки надежной финансовой отчетности, результативности и эффективности деятельности и соблюдения применимых законов и нормативных актов.

В первую очередь система внутреннего контроля должна препятствовать совершению руководством организации, ее сотрудниками и третьими лицами недобросовестных действий. Также система внутреннего контроля призвана обеспечить достоверное и полное представление данных в бухгалтерской отчетности организации.

Наладить эффективную систему контроля можно путем проведения следующих контрольных действий и разработки следующих средств контроля:

- разработка или приобретение качественной и надежной информационной системы обработки данных;

- разделение обязанностей и полномочий сотрудников, подготавливающих бухгалтерскую отчётность;

- разработка методики проведения инвентаризации активов и обязательств, а также обеспечение соблюдения такой методики;

- обеспечение контроля за составлением бухгалтерской отчётности со стороны руководства организации и лиц, отвечающих за корпоративное управление;

- разработка процедур по выявлению руководством рисков недобросовестных действий в организации и реагированию на эти риски, а также порядка информирования о таких процедурах лиц, отвечающих за корпоративное управление;

- разработка в организации Кодекса этики;

- разработка методов проведения руководством оценки способности организации продолжать непрерывно свою деятельность в будущем;

- разработка прочих контрольных мер.

Порядок осуществления внутреннего контроля в организации необходимо оформить в виде внутрифирменного положения.

Кроме того, разработка эффективной системы внутреннего контроля может снизить расходы заказчика на проведение аудита, так как с повышением эффективности системы внутреннего контроля объем проводимого аудита, а также его стоимость, могут быть уменьшены по профессиональному суждению аудитора.

Что осталось неизменным?

Нужно отметить, что критерии проведения обязательного аудита на текущий момент не изменились.

Обязательный аудит проводится в случаях, если:

- организация имеет организационно-правовую форму акционерного общества;

- ценные бумаги организации допущены к организованным торгам;

- организация является кредитной организацией, бюро кредитных историй, организацией, являющейся профессиональным участником рынка ценных бумаг, страховой организацией, клиринговой организацией, обществом взаимного страхования, организатором торговли, негосударственным пенсионным или иным фондом, акционерным инвестиционным фондом, управляющей компанией акционерного инвестиционного фонда, паевого инвестиционного фонда или негосударственного пенсионного фонда (за исключением государственных внебюджетных фондов);

- объем выручки от продажи продукции (продажи товаров, выполнения работ, оказания услуг) организации (за исключением органов государственной власти, органов местного самоуправления, государственных и муниципальных учреждений, государственных и муниципальных унитарных предприятий, сельскохозяйственных кооперативов, союзов этих кооперативов) за предшествовавший отчетному год превышает 400 миллионов рублей или сумма активов бухгалтерского баланса по состоянию на конец предшествовавшего отчетному года превышает 60 миллионов рублей;

- организация (за исключением органа государственной власти, органа местного самоуправления, государственного внебюджетного фонда, а также государственного и муниципального учреждения) представляет и (или) раскрывает годовую сводную (консолидированную) бухгалтерскую (финансовую) отчетность.

В случае, если организация соответствует хотя бы одну из этих критериев, то проведение аудита бухгалтерской отчетности для такой организации является обязательным требованием.

Также напоминаем, что в случае, когда бухгалтерская отчетность организации полежит обязательному аудиту, документация не только должна представляться в контролирующие органы, но и публиковаться вместе с аудиторским заключением.

Итак, 2017 год встречает нас множеством изменений в аудиторской деятельности. Однако несмотря на трудоемкость подготовки к применению Международных стандартов аудита такие изменения должны принести взаимопонимание между аудитором и бизнесом, что является, безусловно, положительным фактором.

Хочется верить, что с введением международных стандартов общественное доверие к аудиторскому мнению возрастет так же, как и востребованность аудиторских услуг.